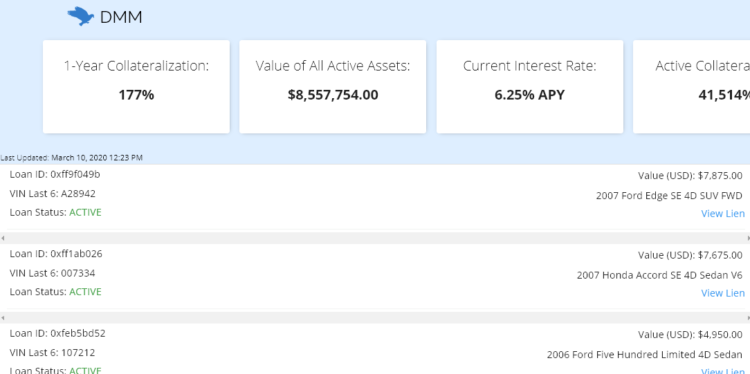

DeFi Money Market (DMM), a protocol to earn interest on any Ethereum-asset backed by real-world assets represented on-chain, today announced the launch of mETH, an interest-bearing token created by depositing ETH into the DMM Ecosystem. DMM will offer 6.25% p.a. on ether (ETH) deposits.

mETH tokens, like all other mTokens, are backed by interest-generating real-world assets which initially include car equity loans. As demand rises, the DMM team plans on expanding the DMM Ecosystem to include a more diverse array of assets in aviation, construction, real estate, and more.

User funds that are deposited in the DMM Ecosystem are converted to fiat and used to transparently purchase a basket of interest-generating real-world assets. This process is initially being performed by the DMM Foundation, but the long term goal is for this to be managed by the DMM DAO.

Both the off-chain assets and interest revenue generated from these assets target over-collateralization protecting depositors.

“At launch, ETH deposited by users will stay in the mETH smart contract to ensure there’s ample liquidity for user withdrawals during this beginning growth phase. As the ETH liquidity in the mETH contract grows to a healthy amount, the DMM Foundation will then withdraw portions of the ETH deposited, up to the reserve ratio (currently set at 50%), and use those funds to be reimbursed for the initial ~$10,000,000 of real-world assets already purchased and afterward to purchase more real-world assets. We will deposit more ETH into the smart contract as it accrues more user deposits and grows in net interest gained. mETH earns ETH depositors a stable 6.25% APY meaning if you deposited 100 ETH today, in 365 days you could cash in your mETH tokens to withdraw 106.25 ETH.”

– The DeFi Money Market team

Last week, Tim Draper as part of Draper Goren Holm Ventures purchased a stake in DeFi Money Market.