Banxa, a full-service internationally compliant fiat-to-crypto gateway solution, today announced the closing of its USD $2 million Series A investment round. Led by blockchain investment firm NGC Ventures, this funding round will be used to support Banxa’s global expansion efforts.

The Banxa team is seeking to enter new markets in Europe, Asia, and Africa. Other participating investors in the raise including the Australian Securities Exchange (ASX) listed Thorney Investment Group Australia, a multi-billion dollar family office that offers asset management, financial planning, and advisory services.

“Banxa is uniquely positioned within the crypto economy, primed to support the ever-evolving financial preferences of a digitally-savvy generation. Banxa addresses the issue of user experience and onboarding while providing the much-needed regulatory assurances for newcomers to this nascent digital asset class. We are thrilled to support Banxa as they embark upon this next phase of growth.”

– Roger Lim, Founding Partner of NGC Ventures

This funding round is also envisaged to support further efforts of onboarding prospective customers as Banxa expands its global payment network.

“After almost six years in the blockchain industry, our goal remains the same – to champion a fairer, more open and more secure financial system for the benefit of consumers and businesses alike. As a global payment infrastructure that looks to become the preferred digital banking service provider of the future, we now find ourselves entering this next phase of maturity as a company as we continue to support users looking to benefit from the full potential of their digital asset holdings.”

– Domenic Carosa, Founder and Chairman of Banxa

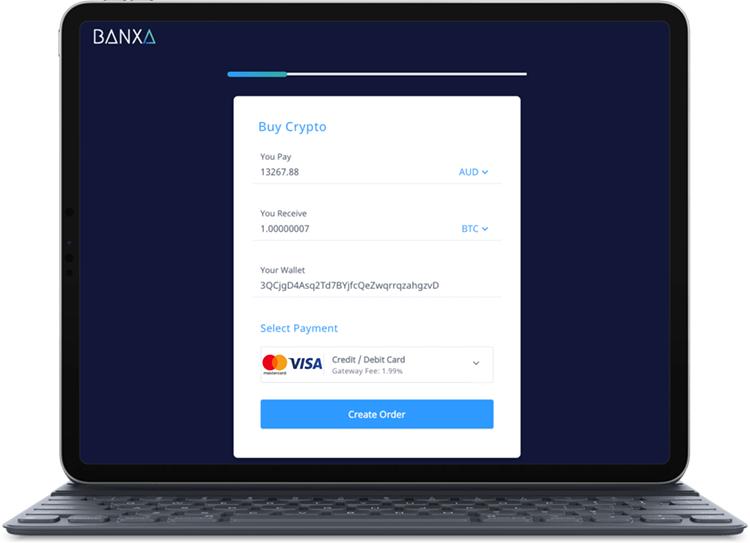

Offering a fully compliant fiat-to-crypto conversion service, the Banxa solution provides regulatory compliance, fraud detection & mitigation, as well as payment reconciliation. The platform incorporates payment options including global credit card providers, bank transfers in the European Union, Australia and the United Kingdom, as well as cash payments.