Euroclear, a provider of post-trade services, and Paxos, a financial technology company delivering blockchain solutions announced this week the successful completion of their second pilot for Euroclear Bankchain, the brand-new blockchain settlement service for London bullion due to go live later in the year.

The two-day pilot included 16 market participants including Citi, Société Générale, MKS PAMP Group, INTL FCStone Ltd, Barrick Gold Corporation, NEX EBS BrokerTec, and ED&F Man and saw over 100,000 settlements.

The first pilot program took place in December 2016 with over 600 OTC test bullion trades settled on the Euroclear Bankchain platform over the course of two-weeks. The pilot was coordinated through the Euroclear Bankchain Market Advisory Group that includes participants working with Euroclear and Paxos in the roll-out of the new service.

Seth Phillips, Bankchain Product Director at Paxos said:

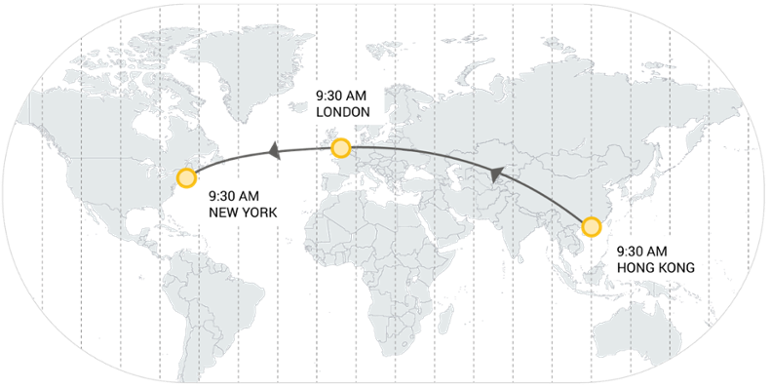

“It has been exciting to watch the growth of the Euroclear Bankchain pilot program over the last month. We doubled the number of firms and significantly increased interaction as participants were spread across six countries and four time zones. Most importantly, we’re proving that the platform can deliver lower costs and lower risk for the London gold market.”

Angus Scott, Head of Product Strategy and Innovation at Euroclear says:

“We are encouraged by the extensive engagement of market participants in this second pilot and will continue as we further develop this new market infrastructure for the bullion market. The feedback provided is of great importance to make sure that our service will deliver real added value to the London bullion market through transparency, capital reduction and delivery versus payment settlement.”

Both Euroclear and Paxos have continued to work closely with the London bullion market executing successful pilots to test and obtain feedback on the Euroclear Bankchain service.

Euroclear Bankchain Profile

Aiming to transform the gold market, Euroclear Bankchain combines Euroclear’s strengths as a leading domestic and cross-border settlement provider and Paxos’ flagship blockchain settlement platform, Bankchain, to bring instant settlement and true delivery versus payment to the London bullion market.

Digital gold tokens can be used as eligible collateral all over the world without leaving the vault. Many global exchanges and clearing houses accept gold as collateral for trading across multiple asset classes, not just in precious metals.