Aave, a protocol for decentralized lending, today announced it has launched on the Ethereum mainnet. Aave is a non-custodial money market platform where users can participate as depositors or borrowers. Depositors provide liquidity to the market to earn a passive income, while borrowers are able to borrow in an overcollateralized (perpetually) or undercollateralized (one-block liquidity) method.

New Features

Features on the protocol launched on mainnet include:

Flash loans, where users can borrow instantly and easily, no collateral needed. Flash loans enable a customized smart contract to borrow assets from our reserve pools within one transaction on the condition that the liquidity is returned to the pool before the transaction ends. If this does not happen, the transaction is reversed to effectively undo the actions executed until that point, guaranteeing the safety of the funds in the reserve pool.

The Aave protocol introduces an innovative tokenization model compared to the current interest-bearing tokens available on the market like cDAI/Chai. Instead of being defined by an exchange rate against the underlying asset, the Aave interest-bearing tokens (aTokens for short) are pegged 1:1 to the value of the underlying asset, and they increase in balance rather than in value.

Launch on mainnet also includes a new interest rate model for borrowers called the stable rate model. Stable rate loans behave as a fixed-rate loan in the short-term but can be re-balanced in the long-term to respond to severe changes in market conditions.

Additionally, newly added perpetual loans give users the freedom to get liquidity from their deposits without any duration or repayment schedule. This is made possible by the over-collateralization of all loans, which is the heart of decentralized finance.

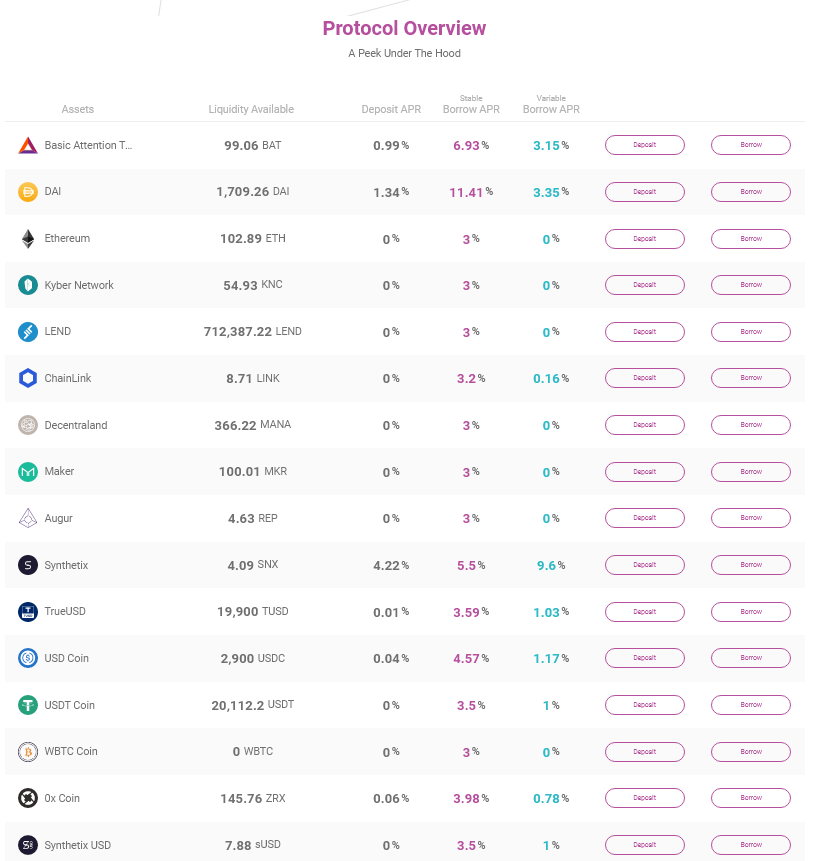

16 different assets, 5 of which are stablecoins, are now available to be deposited/borrowed including: BAT, DAI, ETH, KNC, LEND, LINK, MANA, MKR, REP, TUSD, USDC, USDT, WBTC, ZRX, SUSD, and SNX.

The Aave Oracle Powered by Chainlink

For further decentralization, the Aave Oracle, powered by Chainlink has also been introduced. Integration with Chainlink works to secure 15 cryptocurrency price feeds. Aave is the first lending protocol to leverage off-chain data for calculating lending rates using a decentralized network of price oracles.

Licensing and Open Source

“At Aave we look at software licensing as the first pillar of decentralization. Therefore, to give certainty and we decided to publish the Aave protocol under the AGPL3 License. As DeFi scales, we believe that it is our responsibility to make sure the foundations of this new economy are open both technically and legally. It allows us to stay true to our value while giving more certainty to developers looking to create a business model using the Aave and ensuring the widest distribution of the protocol.”

– The Aave Team