Welcome all, to your weekly price update on bitcoin and gold from Vaultoro.

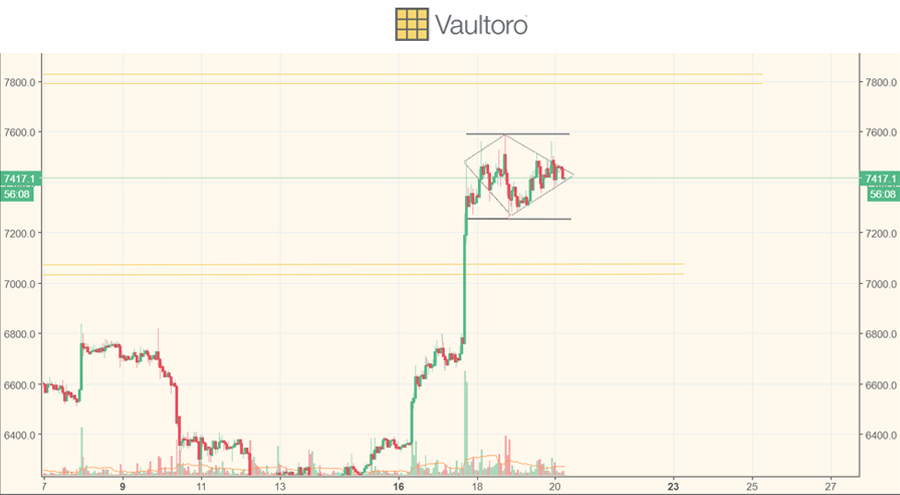

At the time of writing, bitcoin is changing hands for $7,447, and over the past few days has been trading in a range between $7,250 and $7,550.

Since last week, the sentiment has shifted, with feelings of optimism returning to the market amid a wave of positive news. Most significantly, BlackRock, the world’s largest asset manager, has hinted that they might soon start investing in the cryptocurrency markets.

Aside from the fundamentals, there have also been strong technical reasons for optimism, and the inverse head and shoulders described in last week’s update has now fully played out, bringing price action back to the neckline of the pattern at $6,800, and then beyond, with another rally on Tuesday bringing the price to the $7,500 level.

This is where the price has since remained, and technical analysts are currently divided over whether the current price formation is a bull pennant, suggesting bullish continuation, or a diamond top, which would make a move to the downside more likely.

Looking to the future, if the price should break out upwards, then $7700-7800 is the next crucial resistance point.

On the other hand, if we see a pullback then support lies at $7100, and at the $6800 level which previously formed a strong resistance.

XAU/USD – Strengthened Dollar Kicks Gold to the Curb

The gold/dollar dynamic has continued to drive bearish momentum in the price of gold this week, with prices falling to hit new yearly lows around $1,212. At the time of writing, the yellow metal has rebounded slightly and is trading at $1,223.

Despite the ongoing US-China trade war, the price of gold has now dropped more than ten percent over the past three months. The traditional safe-haven asset has been undermined by rampant USD gains, with the dollar index now breaking above 95.50-55 to find fresh highs for the year.

Even after the release of disappointing US housing market data on Wednesday, the dollar continued to rise, triggering another fresh wave of selling pressures in dollar-denominated commodities like gold.

Despite a slight recovery yesterday as Trump voiced concerns about higher interest rates, this downward streak looks set to continue.

If we see a rebound, then first resistance would be encountered at the 50-hour Moving Average in the region of $1,223 (shown in blue), which if broken could set in motion a move towards the 200 hours Moving Average at around $1,230 (shown in purple).

To the downside, key support could be found at the $1,215 level, which other than recent drop has not been hit since last July and yesterday’s low of $1,211. Which if breached could bring the key psychological level of $1,200 into play.