Binance, a new Shanghai-based digital asset exchange is closing in on its one month anniversary since its launch date of July 14th, 2017. Binance stands for “Binary or Bit and Finance” meaning integrating digital technology with finance. The exchange is run by Changpeng Zhao, who is founder and CEO of the overarching company incorporated as Beijie Technology.

Not only does Mr. Zhao’s Beijie Technology have its own exchange now with Binance, but it also provides cloud trading system services for over 30 other exchanges and has a yearly income reaching 36.1 million yuan/5 million US dollars. Mr. Zhao was also the co-founder and CTO of OKCoin, technical director of Blockchain.info, founder of FXI Information Technology Co., Ltd., and Head of Technology of Bloomberg Tradebook Futures in previous roles.

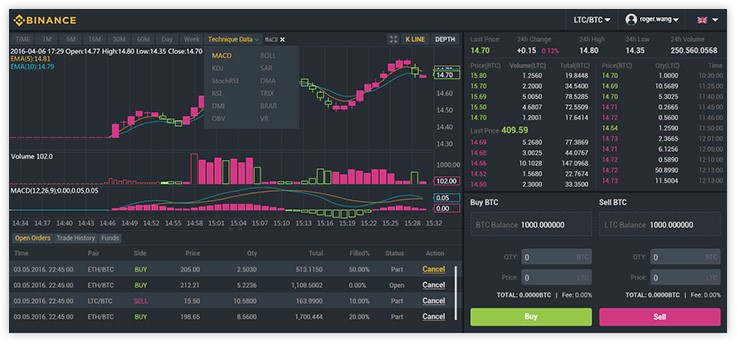

Looking now to promote their own homegrown exchange utilizing the company’s tried and tested platform, Binance has been busy adding new crypto assets week by week since their launch and will keep adding more. Besides BTC, ETH, LTC, and BNB, users can currently trade and invest off those base assets with the following crypto tokens: EOS, NEO, SNT, QTUM, BCC, BNT, GAS, and BTM.

Furthermore, in order to encourage current and prospective clients, the exchange started offering zero trading fees back on July 27th, which will last for one month until August 27th. This is normally a 0.1% fee on each side of the trade. Holders of Binance (BNB) tokens are eligible for fee discounts, currently set to 50% when fees are active.

What are some of the highlights of Binance worth mentioning?

- The exchange matching engine features processing speeds of up to 1.4 million transactions/second, much higher than the industry average.

- Features multiple coin support including BTC, ETH, LTC, and BNB tokens.

- Full platform coverage with support for Web, iOS, Android, HTML5, WeChat, and PC client.

- Will support English, Chinese, Japanese, and Korean on all user interfaces. The very initial release is in English and Chinese only – with more languages to be added over time.

- Regular and Pro platform interfaces.

- Currently available with public API in beta.

- An international multilingual team has extensive working experience in North America, Europe, and Asia to be able to smoothly support the global market.

- No plans to support any fiat currencies.

- The team has developed Binance with security as the foremost concern in their minds. They strive to ensure the platform follows all of the industry best practices when it comes to securing infrastructure and data including ISO/IEC 27001:2013 and the CryptoCurrency Security Standard (CCSS).

Binance’s usage of ICO funds:

- 35% of the funds will be used to build the Binance platform and perform upgrades to the system, which includes team recruiting, training, and the development budget.

- 50% will be used for Binance branding and marketing, including continuous promotion and education of Binance and blockchain innovations in industry mediums. A sufficient budget for various advertisement activities, to help Binance become popular among investors, and to attract active users to the platform.

- 15% will be kept in reserve to cope with any emergency or unexpected situation that might come up.

The revenue model will come from the following sources:

- Exchange Fee – Binance initially will charge a 0.2% fixed fee per trade. Other variations will be subsequently introduced, including maker-taker, volume-based tiering and zero fee promotions.

- Withdrawal Fee – Binance may charge a small fee for withdrawals.

- Listing Fee – Binance will select innovative coins and other assets to be listed on the exchange, there may be a fee associated with those listings.

- Margin Fee – If trading on margin, there may be a fee or interest on the borrowed amount.

- Other Fees – There may be other fees the platform collects for various services such as automated algorithmic order etc.

Before their ICO launch, the Binance team was quoted as saying:

“We know this will be an ultra-competitive space. There are probably hundreds, if not thousands of teams wanting, planning or doing exchanges. The competition will be fierce. But in this age, this is a common risk in any decent concept/start-up or a mature company. The question is: given our team, track record, experience, industry resources, and product, do you believe we stand a better chance than the rest of the pack?”

For more details on team members and exchange plans, see the company whitepaper.