Today it was announced from the Serum community the launch of Vybe DEX, a data-driven trading interface powered by Serum’s central limit order book & matching engine, built by Vybe Network.

Vybe Network is a data infrastructure solution that enables the Solana community to query, index, and share on-chain data to build web3 dApps and analytics.

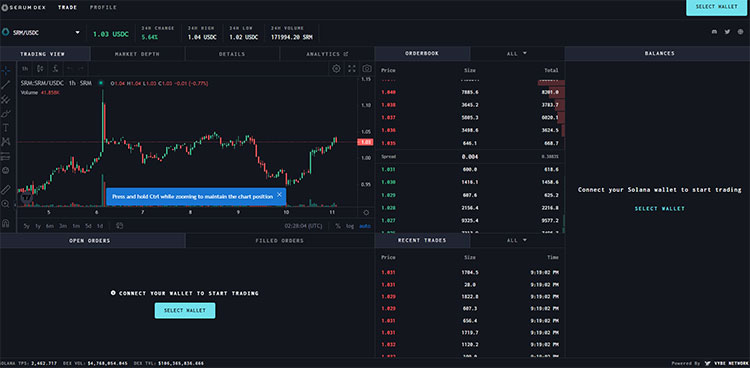

For now, the DEX trading platform is available on a desktop web interface, where users can buy, sell and trade various digital assets using Serum’s liquidity and matching engine.

Now Live: Vybe DEX

Vybe DEX enables users to directly interact with Project Serum, in a fully decentralized manner. Users can place a trade on Vybe DEX in an easy-to-use interface, just as they would on centralized exchanges.

The interface’s functionalities include placing limit and market orders for all Serum markets, viewing open orders and transaction history, live and historical chart data, statistics on order book liquidity, SPL tokens as well as market depth charts.

Users can also access their profile page to view and manage their assets, open orders, unsettled balances, and open order accounts.

Vybe Network

Vybe Network is at the forefront of building on-chain analytics products for Solana.

One of Vybe’s notable contributions to the Serum ecosystem is Serum Analytics (projectserum.vybenetwork.com), a dashboard with real-time data related to Serum including trading volume, total value locked, and top trading pairs.