EthLend.io founder Stanislav Kulechov is introducing a new service whereby users can borrow Ether (ETH), the native digital token used to run the Ethereum blockchain network by using other digital tokens issued on the network. The use of digital tokens ensures the repayment of the loan, lenders will be able to lend Ether without the risk of loss of capital.

ETH usage is growing globally and especially in Asian countries like China, South Korea, and Japan. The outcome results in more demand for lending Ether. Previously lending Ether (or any cryptocurrency) was not sensible since there are no guarantees that the borrower would pay the loan back. Now it is about to change.

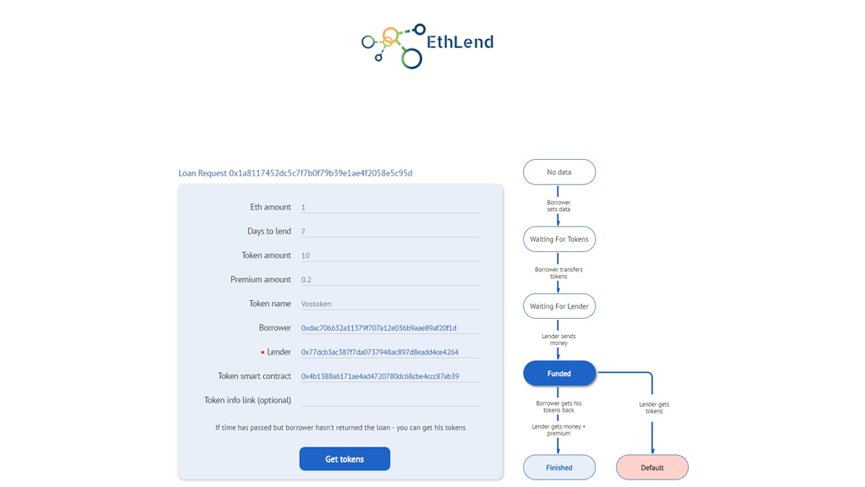

EthLend enables secured lending to Ethereum users. Borrower issues a loan request. The loan request creates a Smart Contract on the Ethereum blockchain. Next, the borrower inserts data to the Smart Contract, such as the loan amount, the premium (interest rate) and time to borrow.

The borrower then inserts the Digital Token address and a number of tokens that are used as collateral. After all the data is set, the borrower transfers the digital tokens to the Smart Contract. From there, lenders can fund the loan.

In case the borrower does not repay on time, the Smart Contract transfers the digital tokens to the lender’s Ethereum address. From this point, the lender can either hold or sell the tokens on exchanges to cover any losses.

EthLend can be viewed as a decentralized application that is running on the Ethereum blockchain. This means that the data is not stored on centrally located servers. Therefore, even EthLend cannot move the tokens from the Smart Contract. This is an example use case on how blockchain can provide more security in the Fintech industry.

EthLend is currently accessed through MetaMask, a Google Chrome Plugin that works as a bridge between Ethereum Network and the browser. For each loan request, the EthLend deducts a 0.01 Ether fee and a 0.01 Ether fee for funding a loan. These fees are used to finance the further development of EthLend.

EthLend Founder Stanislav Kulechov said:

“Each borrower and lender receive 0.1 credit tokens for every for every repaid loan that amounts to 1 Ether. This means that active lending would amount to Credit Tokens that can be used as a collateral. Therefore, the borrower can “spare” other Digital Tokens and borrow against reputation of repayments.”

“Since the launch of Ethereum Domain Name Service, there has been astonishing gold rush for grabbing domain names with .eth –ending. Our next goal is to provide the possibility to use the Ethereum Domain Names (EDN) as a collateral instead of Digital Tokens. This is good news for the borrowers since the EDNs do contain deposited Ether that could be used as a collateral.”

“We are planning to launch an Initial Coin Offering later this year to finance further development of EthLend. We will create a profit sharing structure for the coin holders and additionally shall provide discounts of the loan requests and funding fees. Stay tuned for more exiting details of the upcoming ICO.”