Bancor, an on-chain liquidity protocol that enables automated, decentralized exchange on Ethereum and across blockchains, today announced that xBNT is now live. xBNT a set-and-forget staking solution built by the xToken project that provides automated yield optimization on Bancor liquidity pools.

xBNT introduces a self-driving experience for BNT LPs. Users deposit BNT and xBNT finds the highest-yielding pools on Bancor and rebalances liquidity between pools to maximize profits for xBNT holders. xBNT automatically re-stakes BNT rewards without requiring users to pay gas.

“We are thrilled to see xToken pioneer a meta liquidity layer atop Bancor pools, making LP’ing cheaper and easier than ever. We invite readers to learn more about xBNT in the announcement post by xToken’s core devs, including details on xBNT composability and xToken participation in Bancor governance.”

– The Bancor Team

Automated Yield Optimization

Late last year, Bancor released the first-ever single-sided liquidity pools protected from impermanent loss. Since then, more than 20,000 users have started providing liquidity to Bancor pools, passively earning liquidity mining rewards on top of pool trading fees.

To offer single-sided exposure and IL protection, Bancor contracts must track each individual deposit separately, storing the data on-chain and requiring a great deal of computation in the process. As such, LP’ing on Bancor can be costly in terms of gas, including the manual re-staking of BNT rewards.

xBNT, built by the xToken project, addresses this issue head-on. By bundling BNT deposits together into a single contract, xBNT is able to minimize gas costs for LPs and re-stake BNT rewards autonomously to compound returns on behalf of its users.

How does xBNT work?

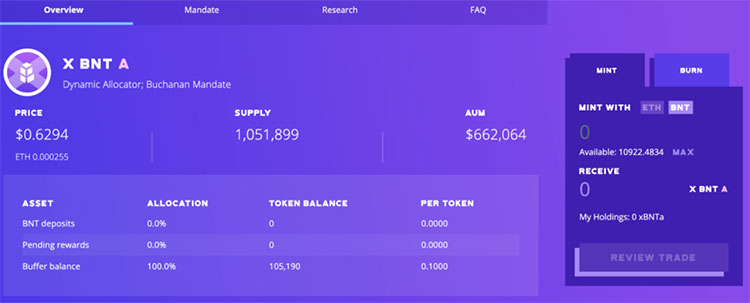

- Enter the system by depositing BNT on xToken Market — which mints xBNT, and sends the xBNT to a user’s wallet.

- The xBNT contract allocates BNT to the highest-yielding pools on Bancor — taking into account each pool’s current yield from trading fees, BNT rewards, time remaining until the BancorDAO must vote to extend rewards on a given pool, and the likelihood of an extension.

- xToken intends to re-stake accumulated BNT rewards every 10–14 days via communal re-stake transactions.

- Track returns via the xToken interface — as fees and rewards accumulate, the value of xBNT tokens rises.

Taking profits

There is no lock-up in xBNT — users can withdraw their full or partial stake at any time. There are two ways to exit the system:

1. Burn xBNT on xToken Market — this liquidates xBNT and returns the equivalent value of BNT to a user’s wallet. While the xBNT contract will always target a buffer balance of 5–10% of BNT held in reserve, there may be times when there is no direct redemption liquidity available on the xBNT contract. In such cases, users may sell xBNT directly on bancor.network.

2. Sell xBNT on bancor.network — users can always swap their xBNT into any token on Bancor, such as BNT, ETH, or USDC. To ensure there is sufficient liquidity in the xBNT/BNT pool, xToken is incentivizing LPs on the xBNT pool with weekly distributions of XTK tokens (participate via xToken Cafe).

What are the costs?

There are four separate costs to consider when providing liquidity on Bancor via xBNT:

- The gas fee to mint xBNT (estimated 100k gas)

- 0.2% mint management fee

- 2% burn management fee

- The gas fee to burn xBNT (estimated 100k gas)

Management fees are subject to change based on the discretion of the xToken community.

As an example, say a user deposits 1000 BNT and earns 100 BNT during the staking period, and for simplicity’s sake, the BNT price remains at $7.00, ETH at $2300, and gwei at 140.

- Gas fee to mint BNT (100k gas = $32.20)

- 0.2% mint management fee (2 BNT = $14)

- 2% burn management fee (22 BNT = $154)

- Gas fee to burn BNT (100k gas = $32.20)

- Total Revenue: 100 BNT ($700)

- Total Costs: $232.40

- Net income: $467.60