CoinLoin, an EU-licensed crypto lending platform, announced it has integrated security protocols from Elliptic, a blockchain analytics provider.

This integration benefits all CoinLoan users as it protects them from a spectrum of cyber threats.

Currently, 66% of the crypto volume runs through exchanges using Elliptic. It covers over 98% of global trading volume, providing actionable insights on 500+ crypto-assets and 100 billion+ data points. Cryptocurrency service providers, institutions, and regulators depend on it to monitor risk and fight fraud.

Choosing Elliptic

“Elliptic offers an optimal combination of recognition, trustworthiness, and coverage of blockchains and digital assets. CoinLoan’s emphasis on compliance is an important competitive strength. Playing by the rules from day one has allowed us to offer convenient fiat gateways and give users peace of mind. With Elliptic, CoinLoan enhances its proactive approach to risk management. Thanks to Elliptic, CoinLoan has already averted a number of withdrawals to scammy addresses. If these transactions had been successful, the senders would have had no opportunity to recover their funds.”

– Max Sapelov, Co-Founder & CTO of CoinLoan

Benefits for CoinLoaners

For users, Elliptic ensures safe withdrawals and seamless transfers.

First, it signals to other platforms that CoinLoan is a trustworthy source, a fully compliant business with high AML and KYC standards. Users can be sure their withdrawals to legit addresses will not get blocked.

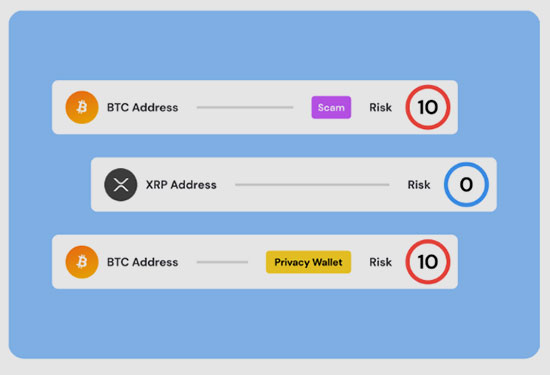

Second, the system halts transfers to flagged wallets like the ones pasted by clipboard hijacking malware.

CoinLoan users do not have to double-check every recipient’s address. If it raises suspicion, Elliptic alerts the CoinLoan team, and it launches an investigation to protect the user.

How it Works

All CoinLoan users will enjoy advanced protection regardless of the services utilized.

Whether managing an interest-bearing account, taking out loans, or exchanging funds, all transfers from the platform are protected by Elliptic.

When CoinLoan receives a request for an outbound transaction, it then sends a query to the Elliptic API. Elliptic checks addresses against its blacklist to protect users from a wide range of attacks and scams. Suspicious transactions are halted automatically and escalated to a manual review when necessary.