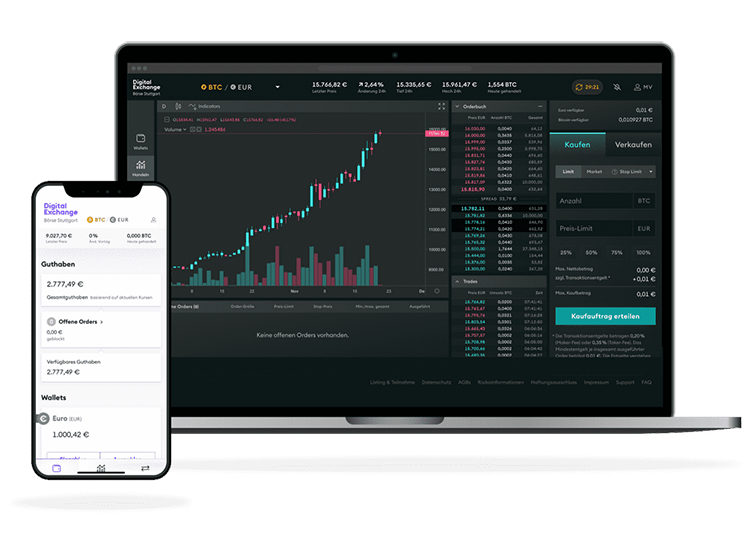

Crypto Finance Group, a FINMA-regulated provider of a full suite of crypto-asset products and services, today announced it has connected to Boerse Stuttgart Digital Exchange (BSDEX) as an institutional participant through its trading subsidiary, Crypto Broker AG.

As a liquidity provider at Germany’s first regulated trading venue for digital assets; Crypto Broker AG will first provide buying and selling prices for the bitcoin-euro market, with ether, litecoin, and XRP to follow.

“We are very pleased to provide deep liquidity and availability to the Boerse Stuttgart Digital Exchange. The Crypto Finance Group’s commitment to regulation and transparency in B2B asset management, trading, and custody of digital assets is strengthened by this partnership.”

– Rupertus Rothenhäuser, CEO of Crypto Broker AG

BSDEX is operated in accordance with Section 2, paragraph 12 of the German Banking Act (Kreditwesengesetz) as a multilateral trading facility by Baden-Wuerttembergische Wertpapierbörse GmbH, which also is the operating company for the public stock exchange in Stuttgart.

“BSDEX offers institutional players a reliable, automated connection to its trading venue with a highly scalable technology setup. We are pleased that with Crypto Broker AG, another leading institutional liquidity provider in Europe is now connected to BSDEX, which further enhances execution quality.”

– Maximilian von Wallenberg, CEO of Boerse Stuttgart Digital Exchange GmbH