Decentralized derivatives exchange Injective Protocol, today announced that it has closed a funding round of $10 million, valuing the network over $1 billion.

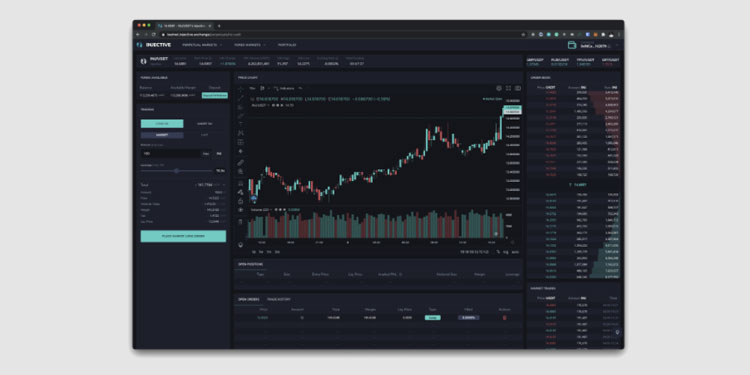

Injective enables instant transaction finality and allows its users to trade with zero fees. Led by a team of Stanford and Harvard graduates, Injective streamlines fully decentralized trading with a fast and secure layer-2 exchange that allows individuals to trade any market, including stocks, crypto, forex, crypto, NFTs, and even synthetic assets.

A group of prominent new and existing investors who participated in the round includes Pantera Capital, BlockTower, Hashed, Cadenza Ventures (formerly BitMex Ventures), CMS, and QCP Capital. In addition, it was also reported that billionaire NBA team owner and Shark Tank judge Mark Cuban made a strategic investment into Injective.

“Legacy institutions and practices create a number of artificial delays and middlemen that prevent innovation in the financial markets ecosystem. At Injective, our goal is to enable an unparalleled decentralized trading experience, whereby retail traders globally can for the first time access limitless markets without the typical predatory fees and slow transaction times.”

– Eric Chen, CEO of Injective Protocol

Previous investors of Injective Protocol include Binance, one of the largest cryptocurrency exchanges, that also incubated the project. Earlier a few Injective team members were put into the international spotlight for joining an anonymous individual known only as Burnt Banksy who created a non-fungible token (NFT) of an original Banksy piece as covered by CBS News, BBC News, The Guardian, and others.