Cardstack, an open-source SaaS for web 3.0, today announced they are introducing a sidechain for transactions for the launch of the Card Pay network. With Card Pay, creators can sell their products and services to customers directly.

Customers can pay for the products and services they need with Prepaid Cards, denominated in a currency they understand. Suppliers can issue and sell those Prepaid Cards to customers, providing easy fiat onramps; and everybody who participates can earn rewards.

“Card Pay ensures that fees only cost a fraction of a penny. Meanwhile, we combine cryptocurrencies, stablecoins, and other types of innovative, smart-contract-backed DeFi instruments with a user-friendly UI. Thereby, we give users without crypto experience the opportunity to do practical day-to-day payments in a decentralized way, participating in decentralized commerce while benefiting from a fun, smooth, and cohesive user experience.”

– The Cardstack Team

What is Card Pay?

Card Pay is a payment and reward network:

- It is based on layer-1 and layer-2 technology.

- Cryptocurrency, stablecoins, and other types of smart-contract-backed DeFi instruments are used to do practical day-to-day payments.

- The system supports decentralized commerce.

“With layer-2 technology coming into the foray, it’s now possible for us to say: If a payment is only gonna cost a fraction of a penny, maybe we can start using cryptocurrency and stablecoins and other types of innovative smart-contract-backed DeFi instruments to go ahead and actually do practical day-to-day payments involving things that look like e-commerce or decentralized commerce.”

– Chris Tse, Cardstack Founder

Card Pay is designed for the creator market:

- Creators can be developers and designers who build new types of cards (mini-applications) that replace the SaaS apps of Silicon Valley.

- Creators can also be regular people who create media, offer goods or services, and build memberships or communities.

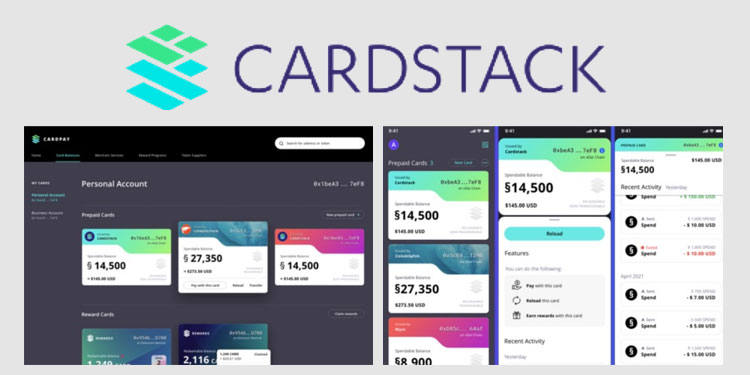

Card Pay consists of a web app and a mobile app:

- Suppliers can deposit funds into the CARD Protocol’s reserve pool and issue Prepaid Cards in the web app.

- Merchants can manage their online stores with the web app.

- Customers can make payments with the mobile app.

- They spend money via Prepaid Cards, which they can reload at any time.

- Customer transactions in the Card Pay network lead to rewards.

How does the ecosystem work?

Cardstack’s ecosystem is a virtuous cycle:

- Developers build software tools.

- Customers use those tools to create new content and data.

- They launch their content and data into shared spaces and workflows.

- Then, users transact with each other, spending money to pay vendors and service providers.

- The resulting revenue allows us to reward developers, designers, and other makers for their contributions.

- In turn, they build more tools, which lead to new content and experiences, based on a shared open-source library.

How does Card Pay work?

Transactions drive rewards:

- Customers spend money via Prepaid Cards.

- Their transactions in the Card Pay network lead to rewards.

- Rewards can be monetary (e.g. reward tokens) or non-monetary (e.g. points, vouchers).

- Non-monetary rewards are NFTs.

- Reward points lead to status, similar to an airline mile status, which may bring further rewards.

- A set of analytics leverages the on-chain history to track active reward programs.

- The CARD Protocol and Tally enable the cycle of spending, earning, offering, and redeeming between customers and merchants.

- Customers can use their earned reward points or vouchers as additional payment methods.