Ankr, a web3 infrastructure platform supporting more than 40 blockchain protocols for staking or developing purposes, today announced in addition to their aETH token, it has now added a second synthetic liquid Eth2 asset to Ankr Staking with fETH, representing Eth2 futures.

ETH stakers in Ankr Staking can now choose between the aETH and fETH liquid assets to redeem. In the end, both assets represent staked ETH + rewards, but in a slightly different way.

fETH

Where aETH represents the user’s staked ETH plus future rewards, so as time passes, 1 aETH becomes increasingly more valuable versus 1 ETH, fETH remains pegged at a 1:1 ratio with ETH.

Instead of the rewards being added to the token value, holders of fETH have their total fETH increase on a daily basis, once they hold their own fETH tokens in their own wallet.

Summary

- aETH is the reward bearing bond asset for liquid Eth2 staking

- fETH is the futures asset for liquid Eth2 staking

How It Works

When a user receives their fETH, they are allocated a percentage of the total supply according to how much they staked. Understand that it’s expressed as a percentage rather than a fixed amount.

Every day, Ankr Staking receives ETH rewards into the fETH Eth2 staking pool and this is used to increase the total supply of fETH by the amount received.

By increasing the total supply, fETH holders have their total token allocation increased automatically because they hold a percentage (and because the total went up, so does the amount they hold).

Example:

- The total pool size is 9,900 ETH which means the total supply of fETH is also 9,900.

- Joe stakes 100 ETH (pushing total fETH supply to 10,000) and gets a 1% allocation (initial balance of 100 fETH).

- Rebase runs and 100 ETH rewards are added to the pool which pushes the total supply of fETH to 10,100.

- Since Joe holds a 1% allocation, the amount of fETH in his wallet will increase to 101 fETH automatically.

(Note, these numbers are just to illustrate the mechanics and aren’t realistic amounts).

How to get fETH?

Users can stake their ETH as normal and then once it has been sent to the contract, users can choose whether to redeem aETH or fETH. Users can then claim whichever one they choose.

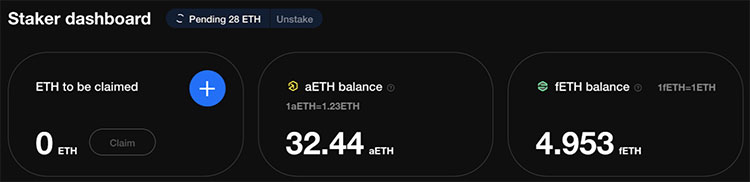

When connected to Ankr Staking, users can now see their fETH balance alongside their other balances: