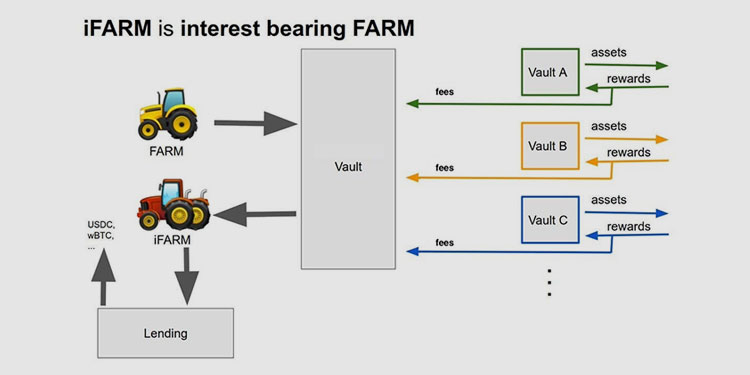

Harvest Finance, a cooperative yield farming protocol, has announced the release of iFarm, a new vault for FARM staking to allow users to hold and stake FARM while collateralizing iFarm.

The iFarm vault follows the same design as current vaults which allow users to deposit FARM and receive fees from the protocol, but they will also receive iFarm as a voucher for their staked share.

These iFarm vouchers allow FARM to stay locked in the vault and earn fees while the iFarm can be used outside of the vault as collateral for a loan, or any other utility.

“Harvest is a tool for the people, and with iFarm, we can bring even more utility and usability to the ecosystem. Being able to stake FARM and use iFarm as collateral while still receiving your share of the fees changes the game for smaller users. They don’t have to worry about paying huge gas fees, while they can benefit from continuous yield and a much more flexible asset.”

– Red, a Moderator for Harvest Finance team

The gas fee of the iFarm vault is about half that of the existing auto-staking FARM pool, providing the opportunity for everyday users or new investors to participate without paying exorbitant gas fees.

The value of iFarm will grow over time in accordance with the value of the fees accrued to the vault. The more fees generated by the platform (currently $12.2M per month), the more the vault and the value of iFARM grows.

The iFarm vault brings utility into the Harvest ecosystem, providing users with lower gas fees, continuous cash flow, and the ability to collateralize on FARM that would otherwise stay locked in a single vault.