JCB, a global payment brand and a credit card issuer and acquirer based in Japan, and Keychain, a technology provider building managed trust solutions for blockchain assets, today announced they have developed a novel infrastructure for processing credit-based micropayments between IoT devices.

The solution promises to enable direct human-to-machine and machine-to-machine payments at scale without the confines of credit cards.

As new networks, such as 5G, deploy and the use of Internet of Things (IoT) devices grow, so will the need for automated and machine-to-machine micropayments.

Mobile payment apps enabled the common mobile user to pay with their phone, however, the current payment infrastructure does not support tens of billions of IoT devices.

Use cases in point examples include: electric vehicles automatically paying for charging, or a farmer receiving payment for produce to a mobile device while offline. Such an infrastructure needs to handle vast cybersecurity and operational risks related to identity fraud, hacking, privacy, and denial of service.

JCB and Keychain have begun solving these challenges by implementing a new blockchain and distributed ledger-based payment infrastructure that mitigates the risks of IoT micropayments.

Micropayment Infrastructure

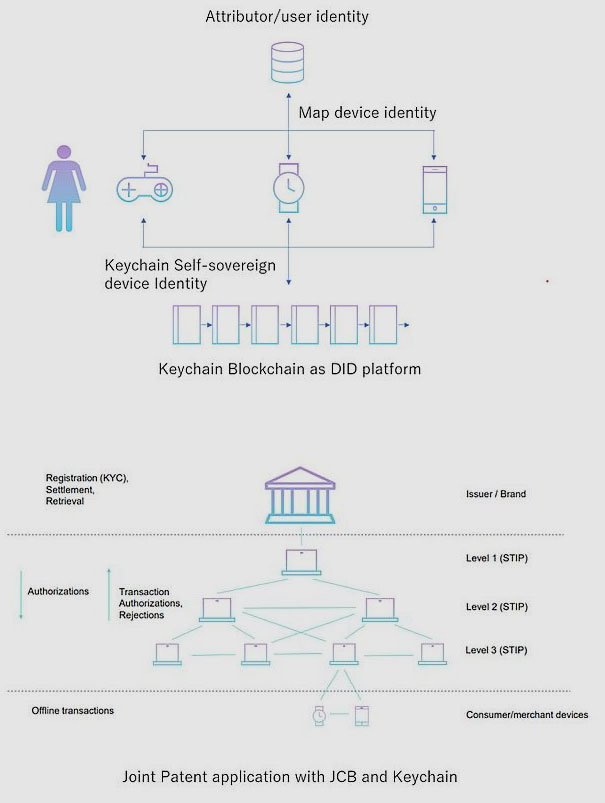

JCB and Keychain developed the solution based on digital identity, delegated transaction approval, and secure transaction archival (joint Japan patent pending #2021-00571).

1. Integrated digital identity

– Each IoT device has a unique, blockchain-based, self-sovereign identity associated with customer identity. This establishes a necessary technical basis for behavior attribution and regulatory compliance.

2. Delegated transaction approval at the network’s edge

– Using Keychain Core’s data provenance capability, the cost, operational risks, and financial risks of payment processing are pushed towards the edges of the network. This enables mitigating large-scale cybersecurity attacks with comparatively large-scale defenses.

– Transaction approval is processed in real-time by devices geographically closer to the location of the transaction.

– The result is a smoother, lower latency user experience and more scalable risk mitigation for the issuer.

3. Secure transaction record archival

– Using identity-based data provenance and security techniques, the system ensures that data is securely relayed to the issuer for compliance and integrity checking.

– The records integrate into conventional settlement systems, leveraging the digital identity-user mappings.

The go-to-market plan consists of enhancing the technology, practical real-world pilots, production infrastructure build-out during 2021, and go-live in 2022.

Keychain Blockchain Technology

Keychain Core, Keychain’s flagship technology product, is a set of software building blocks that enable Keychain partners to easily exploit the power of blockchain and distributed ledger technology. With Keychain Core, Keychain partners reduce operational risks related to data security and achieve new patterns of business. Keychain Core natively supports a wide range of devices including personal computers, tablets, smartphones, smartwatches, and Internet of Things (IoT) devices easy to integrate with existing systems and applications.

Keychain Core main elements are the following:

1. Self-sovereign identity

2. Data-centric security

3. Secure workflows

4. Custom digital assets