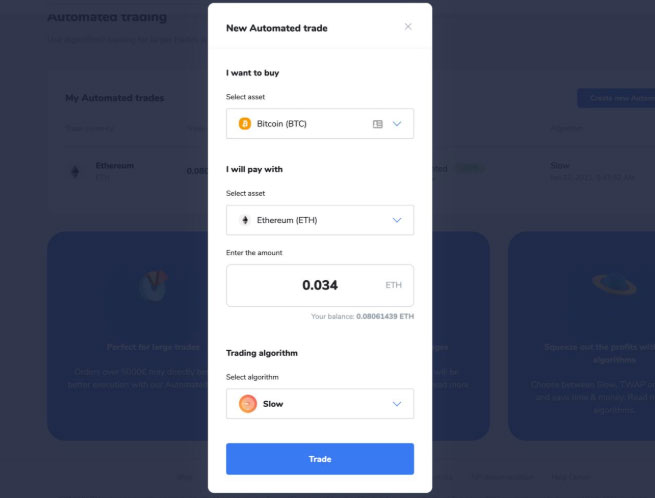

ICONOMI, a platform for crypto-asset management, has announced the launch of automated trading strategies. ICONOMI’s advanced trading engine now allows users to trade automatically across several exchanges, looking for the best prices and executing the order within specific algorithm parameters.

“This feature brings several advantages to users that want to execute larger orders with a specific desired algorithm. Using automated trading on ICONOMI saves time and money in specific scenarios, where users need to execute large orders and lack time or knowledge to do so manually. Instead of simply placing market orders and losing value, users can utilize the ‘Slow’ automated order and wait until the ICONOMI trading engine trades the large order.”

– The ICONOMI Team

Algorithms Currently Offered Include:

- Slow (default) – Places limit orders (best bid/best ask) and wait for them to get filled. If the price changes during this process, the algorithm automatically places new best bid/best ask limit orders.

- Medium – TWAP (time-weighted average price) algorithm trades fixed amounts of assets over a fixed period of time.

- Fast – Places multiple limit orders at the best market price over a shorter period of time.