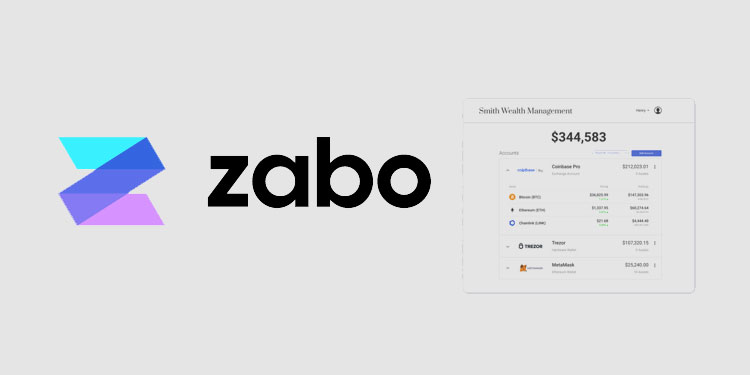

Zabo, a data aggregator for connecting cryptocurrency accounts, has unveiled Portfolio, their latest product specially designed for Registered Investment Advisors (RIAs) and financial advisors to track and manage their client’s bitcoin and crypto assets via a completely white-labeled portfolio dashboard.

Portfolio enables advisors to intelligently engage with clients on cryptocurrency and creates additional revenue opportunities by increasing assets under management. Advisors now have an opportunity to include cryptocurrency as assets under management and collecting related fee revenue.

Zabo’s Portfolio product provides advisors with an easy and powerful way to track and understand their clients’ cryptocurrency holdings in real-time. Zabo’s Portfolio is able to track both leading exchanges such as Coinbase and Gemini, as well as self-custody wallets like Trezor and Ledger, where significant sums of client cryptocurrency are held.

In total, Portfolio supports thousands of cryptocurrencies and integrations with 50+ leading exchanges and wallets, providing detailed balance and transaction histories for all. Portfolio’s white-labeled nature enables this with no engineering cost necessary – plus, the branding is fully-customizable.

“Cryptocurrencies historically have not been tracked by advisors and as a result, are not included in the complete financial picture of clients or overall advisor AUM. This is despite clear data showing that clients both currently hold and are highly interested in the asset class. Both advisors and clients can benefit tremendously from leveraging Portfolio.”

– Alex Treece, Co-Founder, and President at Zabo

Zabo also confirmed two initial partnerships for Portfolio: the Certified Digital Asset Advisor (CDAA) program and SmartKX.