Amber Group, a crypto finance service provider, announced today it has recently surpassed $530 million in assets under management (AUM), a 275% increase from $142M AUM reported in 2019.

With an increasing number of new investors entering the scene, Amber’s surge in demand stems from the extension of their global strategic layout and the launch of the Amber App, an all-in-one crypto finance mobile application geared toward individual investors.

“This year was revolutionary for the crypto industry with the number of new companies and investors entering the space,” said Michael Wu, Founder, and CEO of Amber Group. “We are thrilled to be a part of the growing ecosystem by providing investors with a fully-integrated product suite, where retail and institutional investors can experience a seamless digital asset experience.”

This year, investors have cumulatively traded over $250B (an 85% increase YTD) through the Amber Group with transactions exceeding over $10B in December alone. The Amber Group has grown to serve clients in over 80 countries and regions, such as the Greater China area, South Korea, Japan, Southeast Asia, U.S., Canada, Europe, South America, among others.

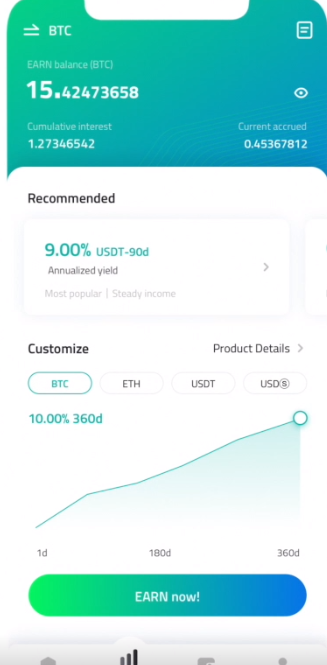

Since the launch of the Amber App in September for retail customers, the App has gained over 25,000 registered users (280% MoM increase) exceeding 15,000 new registered users within the last month of 2020. By offering both sophisticated crypto investors and non-crypto natives a set of highly-intuitive crypto finance tools that enables investors to participate in the crypto markets for the long term, the Amber App has successfully grown to manage over $200M assets (a 30% MoM growth) and has reached over $680M cumulative user deposits since its launch.

The Amber App is integrated with investment features including interest rate products, a way to earn yield (up to 100% APR), the ability to trade to hedge portfolio assets or to capture market upside in volatile markets, and provides spot trading opportunities supporting major cryptocurrencies and stable coins.