Bitcoin is one of the best investments in the decade, with its recent price hitting an all-time high of $19,864 on 30 November 2020. The surge has bought the world’s oldest and most popular cryptocurrency to its year-to-date gain to 177%.

Despite its volatility, Bitcoin has become one of the most popular assets for both institutional and retail investors. The Bitcoin derivative was born as a result to meet the need of investors who are looking to achieve optimal performance by capitalizing on potentially large price movements that were very common on Bitcoin.

What is Margin Trading

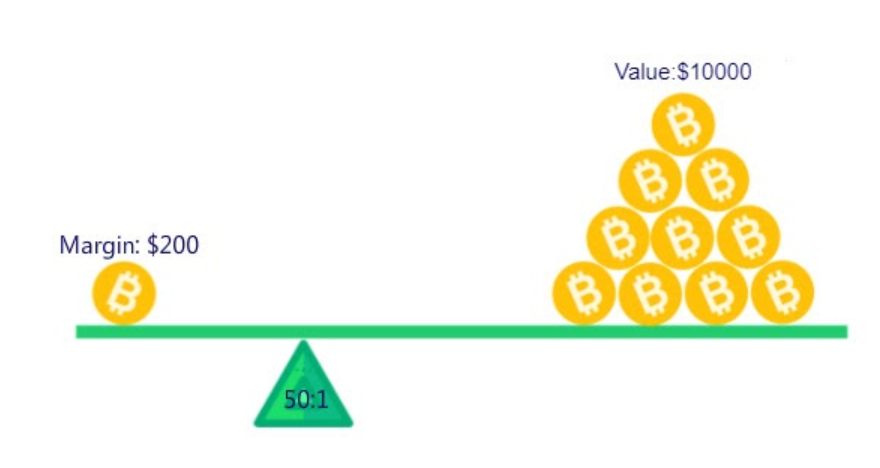

Leverage allows traders to potentially buy or sell any trading instruments that are larger than their deposit amount. For example, Peter has $100 in his account, he can open a buy or sell $1,000 worth of position via leverage. Without leverage, Peter would need to open the buy or sell $1,000 position in full amount.

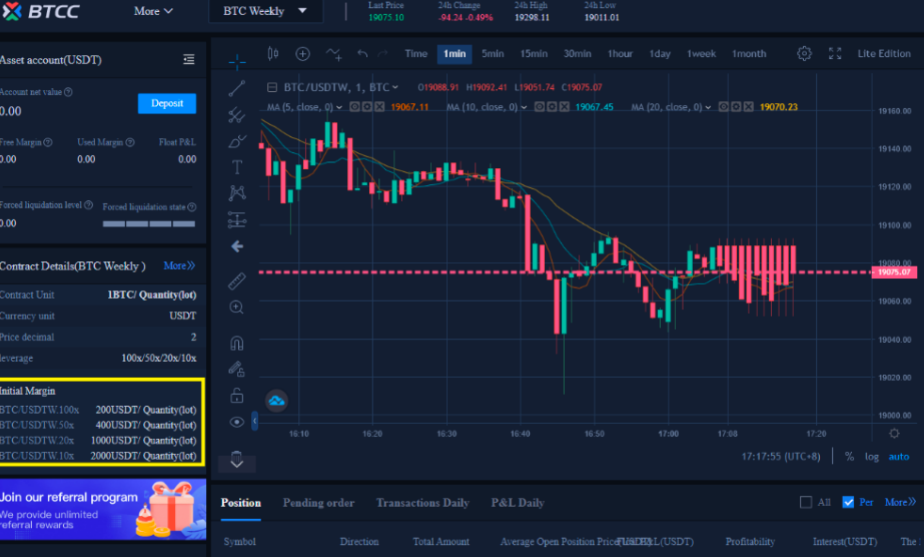

However, how much Peter can buy or sell would depend on the leverage he used. The initial margin required differs from trading pairs and types, you can find it on the left.

You could amplify your potential profit via leverage. For example, Peter deposits 1,000 USDT in his account, with 100x leverage, he is able to open a buy or sell BTC/USDT weekly contract position worth 5 BTC.

Bitcoin Leverage Trading

Trading Bitcoin derivatives with leverage does not require you to own any Bitcoin. You can make a potential profit by predicting the direction of BTC price. Many exchanges offer various leverage for Bitcoin trading. For example, BTCC bitcoin futures trading exchange offers 10x, 20x, 50x, 100x, and up to 150x leverage. Traders can choose the leverage based on their need.

When you open a buy or sell position, a specified amount of funds from your account balance will be served as a collateral to the particular position, this specified amount of funds is known as margin.

For example, if the exchange requires a 200 USDT margin to open 1 lot of BTC/USDT weekly positions with 100 leverage. This means to open a 1 BTC worth of position would require you to have at least 200 USDT in your account.

Margin calls happen when the investor’s margin account drops to the certain amount required by the exchange, and investor is called by the exchange to deposit additional funds to increase the account amount to its minimum value, which is known as the maintenance margin.

Example of Margin Trading

John and Eric both have account balances of $5,000 with an exchange that provides up to 150:1 leverage for Bitcoin trading. John and Eric have different risk appetite. When the price of Bitcoin is trading at $19,000, opening a 100 times leverage BTC/USDT contract requires 200 USDT initial margin and 10 times leverage requires 2000 USDT.

With 100x leverage, John is able to buy a contract value of 25 BTC. While Eric is concerned with the high risk involved with the leverage and he only takes on the 10:1 leverage on the same trade as John, which means he opens a Bitcoin buy position worth 2.5 BTC.

If the price of BTC rises to $19,500 on the next day, John will win $500 x 25 = $12,500, which is 250% of his total account balance. Whereas, Eric only wins $500 x 2.5 = $1,250, which is a 25% of his total account balance.

It is very important to do your own research, and have the strategy to manage your risk. One of the ways to control your loss is to set up a stop-loss order, whereby you can limit your loss by setting up an order to close the position automatically when a certain price level is reached.

When extreme market volatility strikes, many exchanges often make users pay loss when there is a negative balance. However, BTCC provides negative balance protection to cover a user’s 100% negative balance rather than let all profiting users share the losses.

Margin Trading Fees

To trade Bitcoin derivatives, most of the exchanges would charge you an opening fee each time you open a position. If you want to hold the position longer, you will also be charged with a rollover fee, which is a fee for holding a position for a certain period of time.

BTCC is one of the few exchanges in the industry that offer the lowest fees to traders. The exchange charged zero opening fee whenever a trader opened a position. Apart from perpetual contract, there is no rollover fee for its daily and weekly contract. While BTC/USDT perpetual contract at BTCC charged 0.05% of rollover fee every 24 hours. The fees are considered to be very competitive in the industry.

BTCC is one of the world’s longest-running cryptocurrency exchanges. The nine years old exchange offers Bitcoin trading ranging from 100x perpetual contract, weekly contract to 150x daily contract. The total trading reached 98 billion USDT contracts in the last 30 days.

In addition to the English market, BTCC is now available in Korean (비트코인 선물), Japanese (ビットコイン先物取引), and Vietnamese (Hợp đồng tương lai Bitcoin).

Go For A Free Account on BTCC and Try Your First Bitcoin Leverage Trading. Up to 2,000 USDT Deposit Bonus Is Available Now for New Users!