Multicoin Capital, a blockchain and crypto investment firm, today announced it has led a $1.15 million seed round in Swivel Finance, a new decentralized protocol that enables fixed-rate lending and interest-rate derivatives. Swivel aims to make crypto more stable, accessible, and financially attractive to millions of users around the world. Read more about the protocol in their official whitepaper.

How Swivel Works

-

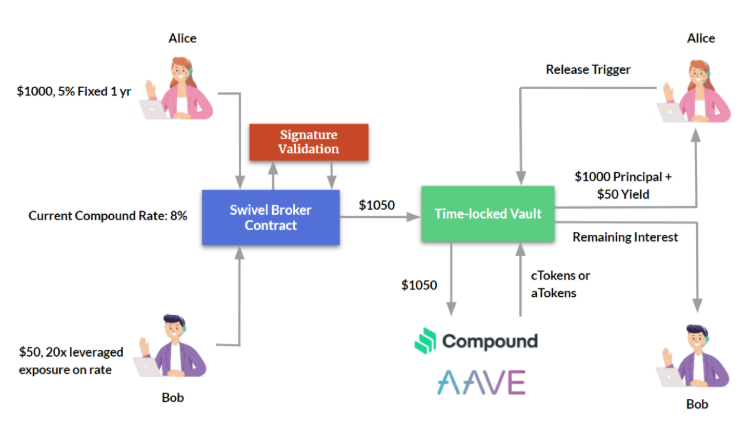

Submit Your Order – Submit the order at your desired rate, or place a market order to originate a lending agreement with a counterparty instantly.

-

Earn Interest – Earn guaranteed a fixed interest on your principal, or leveraged interest on the market rate on protocols like Compound and Aave.

-

Release Your Fund – Once your agreement’s term is complete, release your funds! The fixed-side lender is paid their guaranteed yield, while the floating-side is paid the remaining interest.

“Since the ICO craze of 2017, many market participants have left and have not come back. We’ve been thinking about potential catalysts that could bring the next wave of new users in. With interest rates near historic lows, it’s reasonable to expect that the next wave of crypto users will come from people who simply want to “earn 10% on their USD. Several crypto consumer apps are building front end services for this (Outlet, Linus, Dharma, BlockFi, Celsius, etc), and they currently source liquidity from (1) centralized liquidity pools, and (2) Compound and Aave. Swivel provides fixed rates using the flexible, global, 24/7, permissionless DeFi rails that users want. Swivel creates a new opportunity in DeFi. Today, there is not a way to speculate on DeFi interest rates. Swivel solves this problem—and offers speculators a lot of implied leverage. Leverage will help bootstrap this nascent market, and help Swivel catalyze interest-rate derivatives in crypto. While the Swivel protocol is starting with fixed-floating swaps, we expect them to continue adding new interest-rate derivatives, such as floating-floating swaps, swaptions, floors, and more.”

– The Multicoin Capital Team