Delta Exchange, a crypto derivatives exchange, today announced the debut of its DETO token alongside the launch of its centralized Automated Market Maker (AMM) pool for crypto derivatives. Liquidity mining for DETO via AMM will be opened on BTC-USD and BTC-USDT perpetual contracts. This will allow liquidity providers (LPs) to commit BTC or USDT to pools and earn DETO rewards in addition to returns generated from market-making.

“We are excited to introduce DETO and become one of the first centralized exchanges to explore utilizing AMM for increasing liquidity and lowering slippages on the derivatives side,” said Pankaj Balani, CEO of Delta Exchange. “This will open up yield farming for BTC holders and the Bitcoin ecosystem and will set DETO at the heart of it.”

Currently, Delta Exchange features 54 contracts for perpetual swaps, futures, options, and interest rate swaps, paired against BTC or USDT. The exchange has also been actively listing DeFi coins and was the first to offer futures on LEND, KNC, and YFI. In the coming months, Delta Exchange has plans to expand AMMs for all its contracts including options.

“AMMs on a centralized derivatives exchange for top pairs such as BTC-USD will democratize market making. It will make market-making, which is otherwise capital intensive, accessible to retail customers,” said Balani. “Additionally, AMMs will drive liquidity on Delta Exchange’s order books, resulting in an improved trading environment and giving traders a far superior method of evaluating the platform than just looking at trading volumes.”

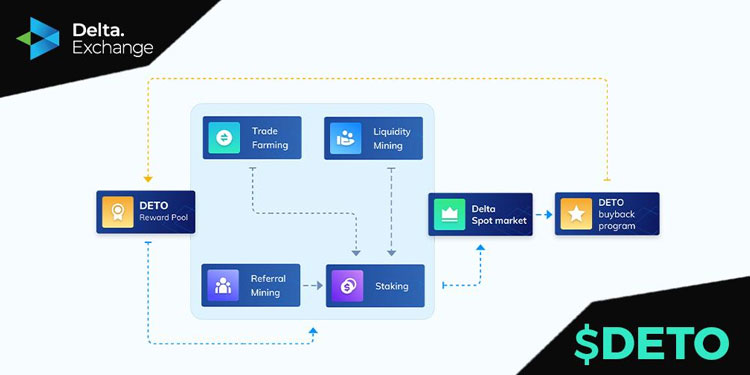

The Delta Exchange token, DETO, will launch with an initial supply of 500 MN tokens; of this 100 MN will be given away as rewards for liquidity mining, trade mining, or referral mining in the first year. DETO earned by participating in these activities will be released on a daily basis.

The Exchange will use 25% of the fees earned on the platform to buy-back DETO tokens. These tokens will be contributed back to the rewards pool, which will be further used for providing rewards for liquidity mining and for other activities in the Delta Exchange ecosystem. DETOs earned can be used to pay fees on the exchange and will be accepted as collateral in the future. Complete details about the token supply, economics, and design are available on Delta Exchange website.

Delta Exchange is hosting a private sale of DETO and interested parties can purchase the token by participating in the private sale. There will be three rounds, with a total of 175 million tokens to be sold in the private sale. Delta Exchange is backed by leading investors and projects like Aave, CoinFund and Kyber Network; and is looking to onboard more of such partners from the ecosystem via this private sale.