The team of DEX aggregator 1inch, today announced it has closed a $2.8M funding round from institutional investors, including Binance Labs, which led the funding round, as well as Galaxy Digital, Greenfield One, Libertus Capital, Dragonfly Capital, FTX, IOSG, LAUNCHub Ventures, Divergence Ventures, Loi Luu, the Founder of Kyber Network, and Illia Polosukhin, the Co-Founder of NEAR Protocol. The first round of investment follows 1inch’s recent milestone of $1B in overall volume.

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges. This aggregator uses smart contract technology to split a single trade transaction across multiple DEXs – enabling users to optimize and customize trades. 1inch has already integrated support from top DEXs including Uniswap, Kyber Network, Airswap, Oasis, Bancor, Balancer, Curve, and many more.

With a funding round under the 1inch belt, the team will continue to expand its growing list of products. In August, the team will release a game-changing algorithm that utilizes 1inch APl to respond in less than a second to find the best trading paths and is completely free for B2B integrations.

Further, 1inch will continue to optimize the aggregator’s API and integrate with transformative technologies in DeFi and blockchain. Moreover, 1inch soon plans to release its own token, introduce liquidity mining (farming) on specific Mooniswap pools and perform an initial AirDrop based on provided liquidity starting from the Mooniswap’s release date.

“DEX aggregation is a critical building block that co-enabled the most recent DeFi boom. It allows executing large order sizes at low slippage rates. 1inch has become the de facto interface for trade execution in DeFi, with aggregate volumes surpassing $1 billion,” said Binance Founder and CEO Changpeng Zhao, “It is of great pleasure to support the 1inch team in their relentless quest to drive user adoption in DeFi.”

1inch is quickly expanding its range of products. 1inch’s new Pathfinder and automated market maker (AMM) protocol Mooniswap represents a turning point in 1inch’s industry impact. Moreover, 1inch provides a platform that allows users to stake tokens and collect revenue from a number of liquidity pools (e.g. Uniswap, Balancer, and Mooniswap).

The Pathfinder consists of a complex search algorithm for swapping routes. This improves the speed and efficiency of the overall 1inch aggregator.

1inch’s automated market maker Mooniswap shifts the landscape of liquidity pools. This unique AMM protocol resolves the major issues of impairment loss by reducing arbitrageurs’ earnings while increasing liquidity providers’ earnings.

With price slippage, users lose significant amounts of their funds to arbitrage traders. When a user swaps a substantial amount of coins, price slippage can deplete user’s funds by anywhere from 2% to infinity. 1inch solves this with its own AMM which allows liquidity providers to earn on users’ slippages unlike any other AMM on the market today.

In addition, Mooniswap deals with front-running attacks, whereby a malicious node observes a transaction after it is broadcasted but before it is finalized and attempts to get its own transaction confirmed before or instead of the observed transaction. The malicious observer then sells for a better price after the user’s transaction in order to earn on that. The Mooniswap is an attractive platform for initial liquidity offerings, largely because it is protected from front-running attacks. Learn more about Mooniswap here.

Sergej Kunz, CEO, and Anton Bukov, CTO, launched 1inch in May 2019 at the ETHGlobal hackathon in New York and in just over a year 1inch has surpassed one billion USD in overall volume. To date, 1inch’s daily active wallets have surged from 115 wallets last year to over 1,200 wallets in July 2020, totaling over 17,700 wallets.

“Our team had first met Sergej and Anton at ETHParis in February 2019 where the two pitched a BNB utility project to us. On a subsequent hackathon, the team launched 1inch and after first traction decided to commercialize it,” said Binance Strategy Officer Gin Chao.

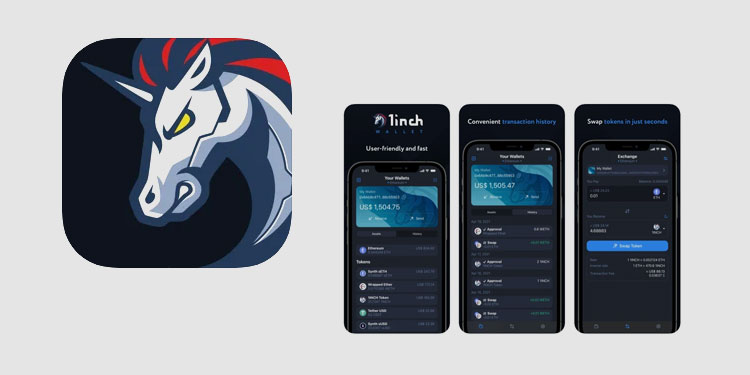

“Throughout a year our team has grown from just two people up to sixteen – mostly award-winning developers from various Ethereum hackathons. At 1inch, we aim to unite traders and liquidity providers, facilitating transactions that are profitable for both sides,” said Sergej Kunz, Co-Founder, and CEO of 1inch. “The funds raised in the first investment round will be used to further grow the team, to develop our algorithm together with new innovative products, and to run marketing activities. We believe that the gold rush in DeFi is in full swing and 1inch has full potential to become the first DeFi unicorn company.”