Hxro is a crypto gaming platform that allows players to earn rewards for being on the right side of price action. To download and read the full report click here.

It has been a relatively quiet week in the crypto space as the markets continued to range sideways, albeit with a firm tone. Out of the blue, Ebang, a bitcoin mining chip producer, filed for a U.S. IPO after failing to get approval to list its IPO in Hong Kong. It is an interesting move considering Ebang saw yearly revenue decrease by 66% between 2018 and 2019. The spectacular flop from Canaan’s IPO is also fresh in investors’ minds, as the Chinese chip maker originally intended to raise $400mn but settled with a raise of $90mn. Canaan shares have seen a steady depreciation in price from $9 down to under $5.

This week in legacy markets is expected to be a wild one as the U.S. mulls over plans to restart their economy slowly as pressure from those displaced from their jobs grows, despite sky-rocketing COVID-19 infection rates. Earnings season continues with the tech sector taking center stage, and with most of the population stuck home, streaming services are already reporting record numbers.

BTC/USD – W (BNC: BLX)

https://www.tradingview.com/x/0CUHfnuW/

Points of Discussion

- Analyst: Nick Cote

- Sentiment: Bullish

- Key Levels: S = $7,150, $6,400 / R = $8,500, $8,200

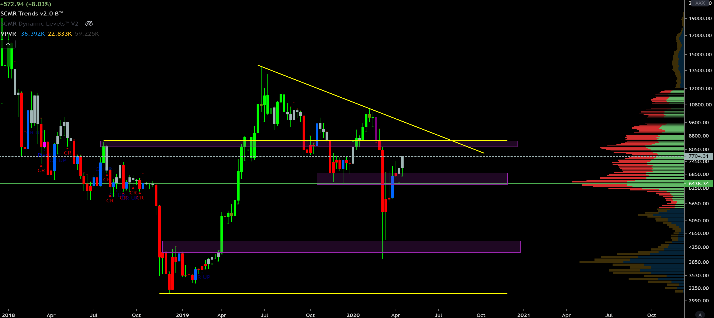

Bitcoin bulls push the market above both the yearly open at $7,160 and weekly resistance at $7,450. For continued expansion upwards, price will need to close above the yearly open at $7,160. The next major weekly resistance block to keep an eye on is between $8,200 – $8,500, which was the ledge from which the market fell back in March.

The market will need to hold above the yearly open at $7,160 if this recent upswing is to continue up above the $8,000 mark this week. Market structure would begin to look bearish if the range lows get violated and flip to resistance, in which case the 2018 support level at $5,800 is the line in the sand for the bulls going into the halvening, which is currently estimated to take place May 11.

Going into another week of earnings reports in the U.S. equity markets, we will be keeping a close eye on SPX price action and how Bitcoin and the other majors respond. This will give us a clue as to whether the correlation between BTC and the broader market is decoupling or maintaining at elevated levels. Bitcoin has been trapped in the $6,400 to $7,450 range for the past couple of weeks, so keeping a close eye on price action on a re-test of the range highs will provide insight if the market has enough steam to run the $8,000 level.

ETH/USD – W (gemini: ethusd)

https://www.tradingview.com/x/UWDD85SZ/

Points of Discussion

- Analyst: Nick Cote

- Sentiment: Bullish

- Key Levels: S = $178, 164 / R = $200, $224

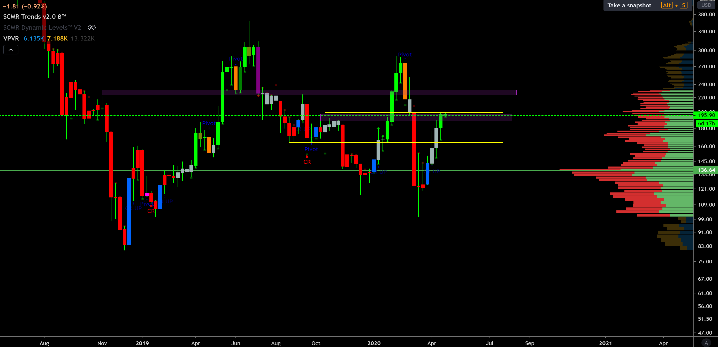

Ethereum bulls continued to impress with another strong week as price pushed above the $194 resistance level and wicked into the March breakdown levels at $200. This completed the full retrace back to the key level in under two months. With as much attention and volume that DeFi has been creating for Ethereum, the bullish fundamental case for Ethereum continues to build on itself.

If the market is to continue higher from here, bulls will need to hold the $178 daily level and flip it to support. This would likely reset momentum enough on intraday timeframes for another run at $200, and the second weekly resistance level at $224. Not only did Ethereum outperform Bitcoin by an additional 5% in the previous week, but open interest continues to remain strong across ETH derivatives products, while OI in Bitcoin fell slightly.

On another positive note, last week’s DeFi blunder which drained dForce funds to the tune of $25mn had no effect on ETH market prices. The hacker leaked critical metadata that was used to identify himself, resulting in all the funds being returned before they could be sold on the market.

Data Center

Key Points:

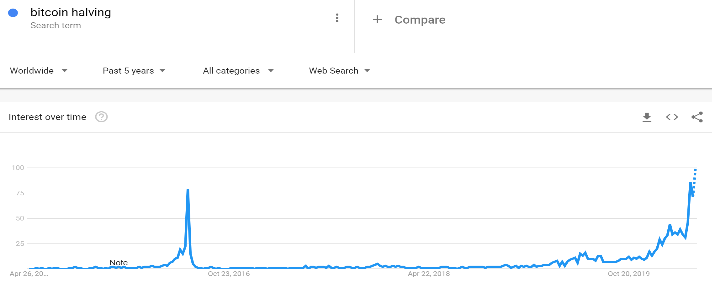

- Global search interest in the upcoming halvening hits all-time highs, suggesting that bitcoin’s network effects continue to grow

- Central banks are actively monitoring and accessing public awareness and use of bitcoin and other cryptocurrencies

- Addresses holding a balance greater than 1 BTC increased by 8% over the past year while on-chain transactions are down 40%

The search interest for ‘bitcoin halving’ has breached that of the previous halvening in 2016, but what conclusions can be drawn from this piece of data? It is important to note that following halvening events, search interest historically flat-lines, and a spike in search interest does not necessarily equate to a price increase. What this piece of data definitively shows is that the network effects of Bitcoin are working as intended – the amount of people that are aware of Bitcoin and have some basic knowledge has grown significantly. For example, the Bank of Canada published a couple issues of its ‘Bitcoin Omnibus Survey,’ which was designed to measure the awareness and usage of Bitcoin in Canada. This survey reported that at the beginning of 2019 over 80% of Canadians were aware of Bitcoin and that about 5% of people had purchased some amount of Bitcoin.

While on-chain transactions are down nearly 40% since mid-2019, there are plenty of other metrics that suggest the Bitcoin network continues to be in one of its healthiest states, as hash rate approaches all-time highs and the amount of addresses holding balances greater than 1 and 5 BTC have been trending upwards, posting an 8% gain over the past twelve months. The growth in these metrics adds validity to the argument that both Bitcoin adoption and accumulation are well underway, despite an underreporting from mainstream outlets.

DeFi-Checkup

Key Points:

- The high frequency of smart contracts or other elements of DeFi technology getting abused is proof that the technologies are still in beta

- Many DeFi projects rely on easily manipulated price oracles and Coinbase hopes to solve this with its own oracle product

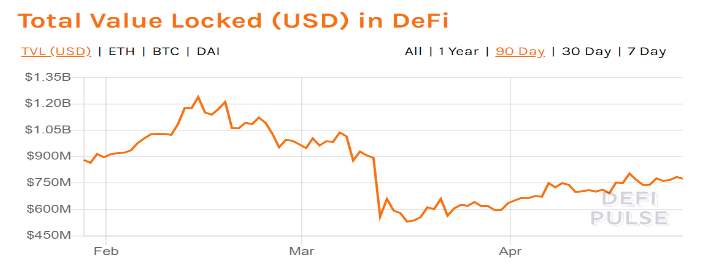

- Total amount of dollars locked in DeFi is up 36% from the recent market crash and multiple contract exploits, which signals users are still very confident in the space

We have previously written about the astonishing growth in the DeFi space, and how it has emerged as a primary driver for growth in Ethereum in particular. But with new technology comes new challenges. In three of the past four months, the DeFi space has suffered and learned from some type of attack which resulted in a loss of user funds, totalling more than $26.5mn.

Security standards need to improve, and a constant point of attack has been price manipulation via the price oracles, which can be easily manipulated when liquidity is low and pricing data comes from one source. This is a problem that has broad implications, as many DeFi projects, such as bZx, use price oracles in their products. To address this, Coinbase recently launched its own solution called ‘Coinbase Oracle,’ which is a signed price feed that anyone can access and publish on-chain.

Amid these setbacks, which serve as real-world learning opportunities for developers, users continue to flock to these new and innovative products, as the total amount of U.S. dollar value locked in DeFi is up 36% from the March crash. This should act as a signal to investors and developers that for now, the potential capital gains and value creation in the DeFi space heavily outweigh the risks.

Hxro is a crypto gaming platform that allows players to earn rewards for being on the right side of price action. To download and read the full report click here.