The Avantgarde Finance, a lead developer of blockchain asset management protocol Melon, recently announced the release of v2.0 of the Melon Terminal (a.k.a. Melon Manager Interface).

As the lead developer of the Melon protocol, Avantgarde Finance developed a new browser-based and open-source interface to access the Melon protocol for Melon managers and investors. Major improvements in performance and stability have been made for v2.0 from Manager Interface v1.0.

v2.0’s interface runs on a new version of the Melon protocol (v1.1.0) deployed in February and vetted by the Melon Council through a protocol upgrade vote. Note this is the first release by Avantgarde Finance.

Melon Terminal Features

Browsing the Terminal as an Investor

In order to be able to subscribe to funds, investors need to log in with an Ethereum account; they can do so with Metamask, Frame, Coinbase Wallet, Dapper Wallet and Fortmatic (more to be added).

Once logged in, investors can visit the Invest/Redeem section of the fund they are interested in and make an investment request. This same interface allows for the redeeming of assets from the fund at any time.

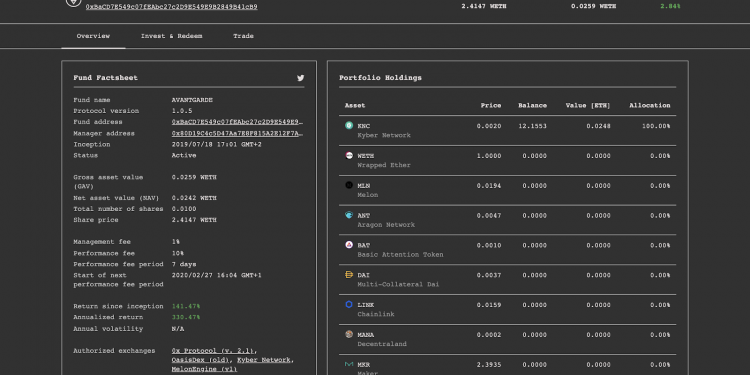

It is possible to invest in a fund using any of the assets that the fund accepts as a subscription asset, as indicated in its factsheet. If wanting to invest in a fund using ether, users will need to wrap their ether to get WETH (which can be done in the wallet section).

Browsing the Terminal as a Manager

Here, managers will need to be logged in with an Ethereum account in order to create a fund. Once logged in with some ether in their wallet to pay for Ethereum and Melon gas; Managers will see a button in the top right corner to create a fund. The fund creation process is straightforward, and will require users to sign 9 transactions that will deploy the different components of their fund.

Operating a Melon fund is a way to:

- Manage all Ethereum-based investments in one place (in the future, including access to lending protocols and other exciting integrations).

- Build an immutable on-chain track record.

- Pool capital to execute strategies on a larger scale.

Managers have access to the full feature set of Melon:

Invest/Redeem section

- Managers can invest in their own funds (and others).

- Redeem assets at any time.

Admin section

- Switch the DEX’s the fund trades on.

- Change subscription assets accepted as an investment into the fund.

- Collect management and performance fees.

- Shut down the fund at any time.

Ruleset section

This section allows managers to deploy policies that will be enforced by the smart contracts throughout the lifetime of a fund. Users can deploy as many as they want; but once a policy is configured in the fund, it cannot be removed. This ruleset serves a simple purpose: providing guarantees to the investors of a fund on the behavior that can be adopted.

Currently, 6 policies are available (more to be added in the future):

- Price tolerance: Sets the maximum (harmful) deviation in trade price from the current market price source.

- Maximum number of positions: Defines the maximum number of different asset tokens which can be held in the fund at any one time.

- Maximum concentration: Maximum value as a percentage of fund value that any single position can have.

- Investor whitelist: A list of Ethereum addresses that are allowed to invest in the fund. If this policy is not set, the fund is open to anyone.

- Asset whitelist: Asset tokens eligible for investment by the fund.

- Asset blacklist: Asset tokens that are ineligible for investment by the fund.

Trade section

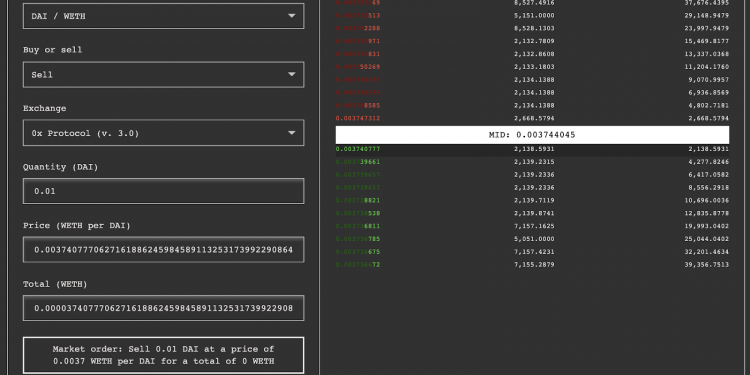

This section allows entering and exit positions in a portfolio (ie. rebalancing into the desired allocation). A Melon fund can hold any Melon supported asset (currently 19 assets, continually being expanded).

There are 3 ways for a Melon manager to trade on behalf of the fund:

- Trade against an aggregated order book: The order book displayed below aggregates offers from OasisDex and from all the 0x relayers through the 0x Standard Relayer API.

- Trade against liquidity pools: On v2.0, both Kyber Network and Uniswap are integrated.

- Trade through a non-custodial RFQ (Request For Quote) system: Make a request to a market maker, who will send back an offer. If accepting the offer, the settlement will occur on 0x contracts.