SWARM, an open-source tokenization network, has announced that its recently launched premium service, Swarm Capital is launching the SWARM app: a self-serve tool that is capable of issuing fully regulatory compliant digital securities or tokens.

Named for the nonprofit, open-source protocol that it’s built upon, the SWARM app empowers users to utilize the core feature list of the latest SRC20 smart contracts deployed on the SWARM Protocol, the open, regulatory compliant infrastructure for digital securities.

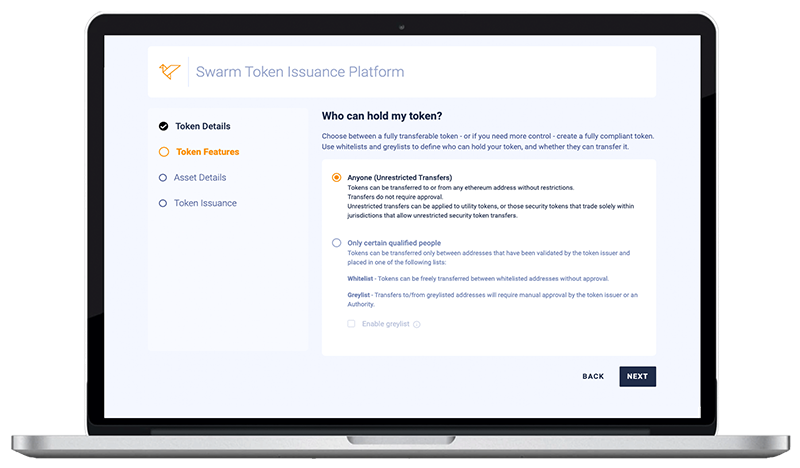

The SWARM app intuitively guides token issuers through a friendly UI, beginning by defining and configuring, then minting, and eventually issuing a fully regulatory compliant SRC20 security token. Token issuers have a choice of deploying tokens to Ethereum testnets (Ropsten) — and when they’re ready, mainnet deployment is just a few clicks away.

Simplifying The Process

A key objective of the SWARM app is to demystify the process of creating and issuing security tokens.

SWARM believes the token creation process has suffered from complexities — both from a technological as well as a regulatory perspective. Creating testnet security tokens allows prospective issuers to mint, issue, distribute, set transfer restrictions, employ various contract features, and experiment with a fully-featured and compliant security token, all without requiring any commitment in capital or real staking.

Regulatory compliance is achieved using SWARM’s uniquely simple approach. Token issuers simply whitelist addresses that are allowed to freely trade the token between each other, and greylist any addresses that are subject to any restrictions or rules needing to be checked or verified by the token issuer or an authority. Addresses that are in neither list are effectively forbidden (blacklisted) to hold or transfer the token until completing the specific qualification requirements for the respective token. Qualification is done using SWARM’s Investor Pass.

SWARM’s no-fee tokenomics means that security tokens can be created and issued on mainnet by simply staking SWM tokens into a smart contract. Retrieving a stake is done by decreasing the supply of the security tokens (sending them to a decrease supply function in the smart contract). Issuing on testnet simply requires mock SWM tokens (which can be provided by request).

“We invite anyone and everyone in the security token space (token issuers, advisories, journalists, investors, and those simply curious) to create testnet security tokens using the SWARM app today. There’s no obligation, and you’ll be helping us achieve our goal of having 100 testnet tokens issued in the first month. To advance the industry we are convinced that we need to get back into a state of iteration to bring forward the best use cases for security tokens. With today’s release, we are dramatically lowering the barriers and inviting the community to give it a try.”

– The SWARM Team