Token price dynamics and solutions to price impact

To understand the factors that influence utility token prices, it is important to compare and contrast the market dynamics of share prices. This method helps to identify the key factors and fosters a greater understanding of the pricing of utility tokens.

Share price impact

The primary factors affecting share prices are:

Earnings

- The price of a share is driven by expected future earnings of the company;

Dividends

- The price of a share is driven by forecasted dividends paid by the company to its shareholders;

Market factors

- Various external market factors that affect demand.

Company valuation

A company valuation is comprised of further factors, specifically:

- Business prospects and growth;

- Profitability;

- Company size;

- Stability and expected performance in the foreseeable future;

- Management quality and corporate governance.

In summary, we can aggregate all the above factors into a singular expression:

![]()

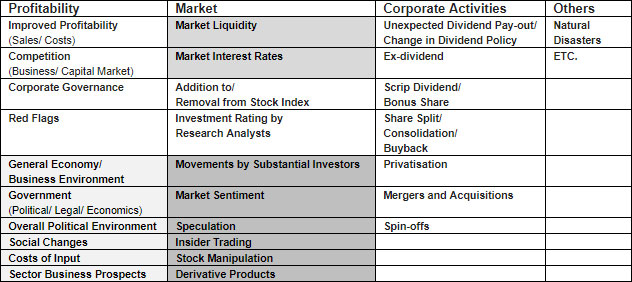

By tabulating the factors, we can derive a matrix of factors as shown.

Alternatives for fintech companies

Since utility tokens are not securities, it is important to understand that they can still include functions that mimic corporate actions such as dividends. We can also emulate company profitability in order to generate rewards for using utility tokens.

Dividends alternatives

Actions:

– Demonstrate the existence of utility through the architecture of utility tokens;

– Inform and explain to the user community how utility tokens can be used and demonstrate the monetary savings available to token holders;

- In addition to savings, token holders can also generate earnings in a similar way to company dividends. This is what is known as ‘Token Economics’;

– Peripheral factors are also incredibly important to build trust and transparency amongst token holders. Ranging from informative videos, websites and interactive content, all the way through to formal audits, robust legal advice and mutually beneficial terms and conditions.

Solutions to profitability

Actions:

Launch a mobile phone application, including regular updates and persistent app development to introduce new features and remove latent bugs or inefficiencies. This process would also be underpinned by a rigorous feedback mechanism to gauge token holder satisfaction.

Competition (business / capital market)

Actions:

– Demonstrate how your particular token is superior to other alternatives via a broad range of websites and media outlets. Investor relations and public relations are essential considerations to maximize the uptake of utility tokens;

– Produce innovative content and formal documentation such as:

- A teaser, a pitch deck, a new whitepaper, a video, a new website, and an MVP;

– Entering new partnerships with third parties and vendors:

- Payments, banking, software, security, biometrics, KYC, AML are all important features that token holders expect.

Corporate governance

Actions:

– Advisors such as:

- Banking Advisor;

- Payments Advisor;

- Technology and Security Advisor;

- Regulatory and Compliance Advisor.

– A functional management team such as:

- Chief Executive Officer, responsible for the overall company performance;

- Chief Operational Officer, responsible for the company operations;

- Chief Financial Officer, responsible for the company finance;

- Chief Technology Officer, responsible for the IT operations;

- Chief Marketing Officer, responsible for the marketing operations;

- Chief Risk Officer, responsible for the risk management department;

- Chief Product Officer, responsible for the product development department;

- Head of Data Science, not a Management Board Member, but has observer status (data verification resource).

– Good partners:

- Legal;

- Accounting;

- Security Partners.

Red Flags

Actions:

– A new roadmap:

- A step-by-step roadmap;

- A viral video:

- that drives understanding and token uptake as well as explaining the societal benefits of using utility tokens;

– Ask Me Anything (AMA) sessions help to build trust, provide feedback and allow for key issues to be prioritized:

- Discussing investor concerns;

- Discussing the product and its ongoing development;

- Provide a stage for information discovery including major developments occurring worldwide.

Solutions to Market

Actions:

- Attract high-profile institutional investors (press release, etc.);

- Attract influencers;

- Attract high-profile employees;

- Create a trading team to market make (stabilize);

- List on a reputable exchange (Binance, etc.).

Corporate Activities to Market

Actions:

– Acquisitions

- i.e. a blockchain company (media);

– Special acquisitions

- i.e. such as the .COM domain;

– Buyback

- Use part of the FCFF (free cash flow to the firm) for the buyback and for ‘destroying’ tokens to reduce the total supply;

- This leads to higher prices as long as token demand remains stable;

– Sales and discount

- Paid traffic (users, ratings, comments, likes, etc.);

- Partnership program;

- Make a discount (campaigns) for token holders, i.e. discount must be proportional to the stake amount;

– Structure of capital transparency

- Disclose various information about major token holders to incentivize minor holders and potential buyers to become future holders;

- This would help to create a positive feedback loop as more holders lead to higher returns for the rest of the community, which in turn attracts more users.

– Audit

- Regular audits and full transparency of the entire architecture help to maintain trust and fosters price stability over the long-term.