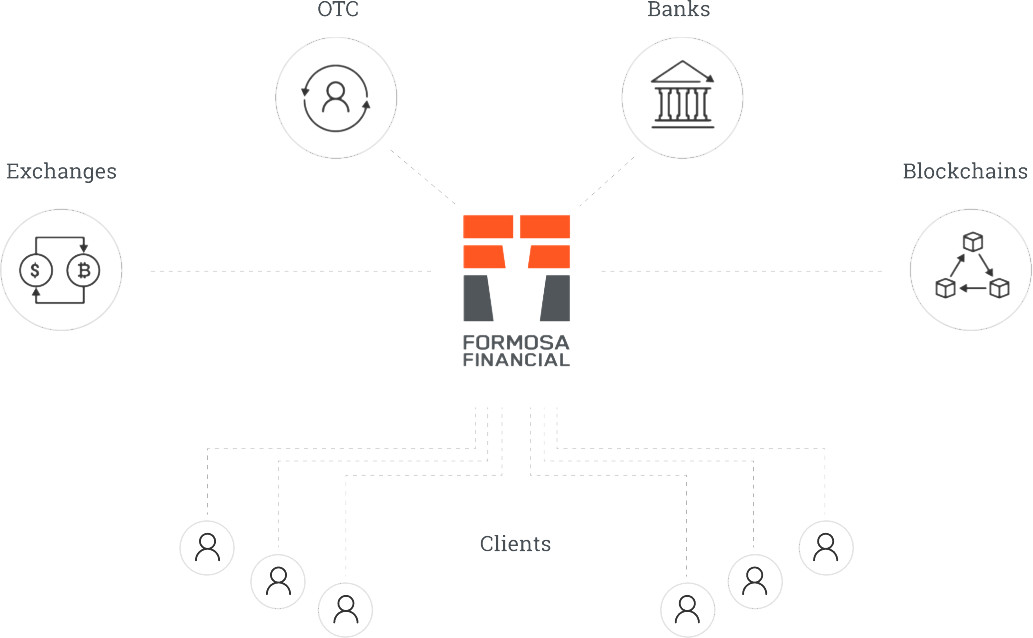

Months after teasing a sneak peek into the functions of their new treasury management application, Formosa Financial has now released an alpha version. The app is designed to offer financial services including risk management, asset custody and brokerage from one platform. According to the team, the purpose behind the app is to make life easier for blockchain innovators by allowing them to focus on their business while seamlessly managing their financial needs.

It is currently available on Bitcoin and Ethereum testnet blockchains.

Speed and Access to Fiat

Formosa advertises simplicity as the backbone of the app, which it says will significantly help digital asset owners. The release mentions that the app simplifies transactions and adds extra layers of reliability, speed and security. According to Formosa, it also solves a major issue that crypto businesses typically face, which is access to fiat. An excerpt from the announcements reads:

“Banks have long been wary of working with clients holding cryptoassets due to an uncertain regulatory environment and challenges in identifying the source of funds by working with industry leaders and implementing our own strong AML controls we are able to seamlessly provide access to fiat through industry-leading US banks with our integrated custody and cash settlement solutions.”

Eliminating Redundancy

The Formosa app also eliminates issues of opening multiple accounts, going through the hurdles of providing multiple documents for KYC in different institutions and holding multiple passwords. By providing a single account which provides all these services, Formosa believes it makes it easier for crypto businesses to focus on their core activities.

Formosa admits that the app is not yet perfect, stating that while users may experience bugs with the alpha release, the team will keep working on bug fixes and data corruption cases as other versions are pushed out. The release is also not yet available on mainnet so no real funds would be lost in cases of crashes, hacks or data corruption.

The treasury management company has also partnered with BitGo to incorporate an extra layer of security as well as proper wallet management and accounting database system which works for both centralized and decentralized applications. The application makes use of 2-Factor Authentication to make sure only registered users have access to withdraw funds. To make transactions more secure, users are required to update withdrawal addresses to a whitelist when they register, which reduces the chances of hacks or human error.

Those who are interested in trying this early version out, can submit this form .