Deutsche Börse Group, one of the world’s largest market infrastructure providers, Swisscom, the leading Swiss Information and Communication Technology (ICT) company and one of its leading IT service providers, and Sygnum, a Swiss and Singapore-based financial technology company in the regulatory process to obtain a Swiss banking and securities dealer license, have entered into a strategic partnership.

The aim of this cooperation is to jointly build out and grow a trusted and regulatory compliant financial market infrastructure for digital assets.

The tokenization of assets, the next major phase of asset digitization, has the potential to reshape global financial markets. In order to fully unfold its potential, the emerging tokenized economy needs a trusted, comprehensive and regulatory compliant ecosystem. This integrated ecosystem around digital assets, developed by strong and experienced partners, will enable investors to tap into these new asset classes and accommodate future client needs.

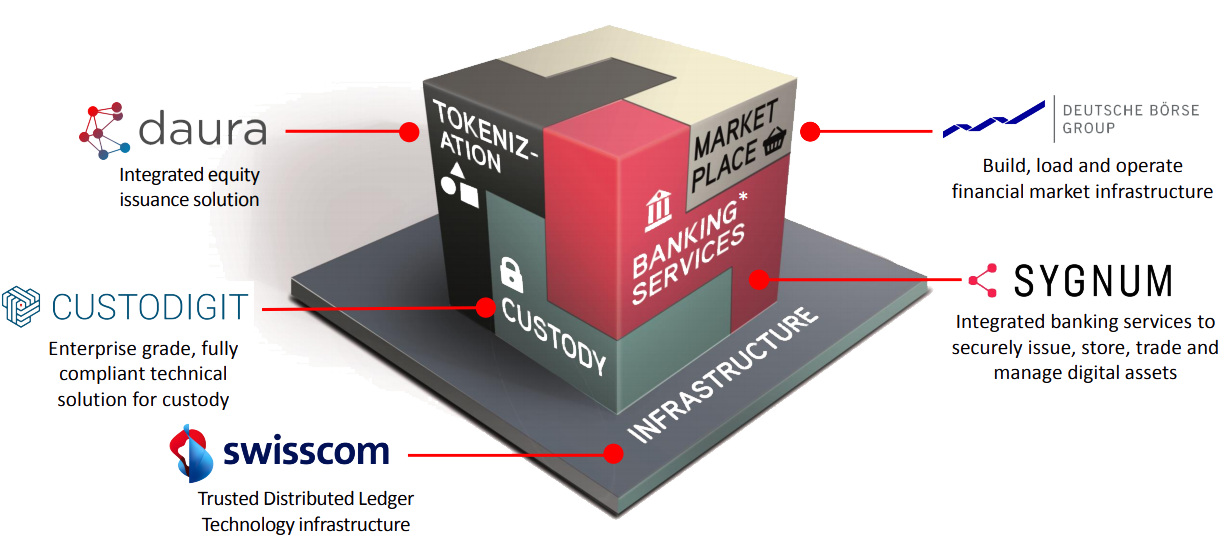

The core elements of the solution will include issuance, custody, access to liquidity, and banking services – all leveraging Distributed-Ledger-Technology (DLT) in a regulatory compliant environment. The strategic partners will jointly grow and enhance these foundational elements of the digital asset ecosystem in alignment with the requirements of market participants.

The strategic partnership includes an investment by Deutsche Börse in Custodigit AG. The company was founded in 2018 as a joint venture by Swisscom and Sygnum. Custodigit AG provides a technical solution for the custody of digital assets for regulated financial services institutions. The integrated platform allows bank customers to manage the entire life cycle of their digital assets. As one of the main shareholders, Deutsche Börse will actively support the growth journey of Custodigit AG and its service offering.

Deutsche Börse and Sygnum will become shareholders of daura AG. The company has developed a platform that uses Distributed Ledger Technologies to issue, securely transfer and register Swiss SME-shares, enabling non-listed companies to access the capital markets. As investors, Deutsche Börse and Sygnum will be actively involved in the companies’ future development.

Moreover, Deutsche Börse and Sygnum are currently conceptualizing the establishment of a further building block of the ecosystem – a listing and trading venue for digital assets in the Swiss market. Access to liquidity via an open, regulatory compliant marketplace is considered a critical element for building a scalable digital assets ecosystem.

Following obtaining a Swiss banking and securities dealer license from the Swiss regulator FINMA, Sygnum will provide comprehensive banking services such as custody, deposits, credit & lending, capital issuance via tokenization, brokerage and asset management within the digital asset ecosystem. The ecosystem established by the partners is based on Decentralized Ledger Infrastructure developed and operated by Swisscom, meeting security requirements of financial services institutions and allowing for scalability.

The first products and services provided by the new ecosystem for digital assets are expected to be launched in the course of 2019.

The transaction is subject to merger control clearance.

“This cooperation, the complementary infrastructure and expertise of the parties involved, is a great opportunity for creating a comprehensive and market leading ecosystem for digital assets. With Swisscom and Sygnum we have two highly recognized partners on board and we are looking forward to bundle forces. Continuing our investments in new technologies and driving the development around DLT forward is a key focus of Deutsche Börse Group. Switzerland, known to be a nucleus for financial markets innovation, is the ideal starting point for Deutsche Börse to drive this evolution forward.”

“The collaboration with Deutsche Börse and Sygnum is the perfect step for the development of a comprehensive digital asset ecosystem. The cooperation allows to advance our vision of an extensive solution for the registration, safekeeping and transfer of digital assets. The partnership combines unique know-how in the fields of digital assets, banking, compliance and technology. Thus, we are in the perfect condition to create solutions for regulated financial service providers that are based on security, reliability and compliance, and enable them to enter a new financial services era.”

“Sygnum’s banking expertise and ability to innovate rapidly using Distributed Ledger Technologies, combined with Deutsche Börse and Swisscom’s experience in building and operating scalable financial services infrastructure, is a winning formula. We are thrilled to embark on this journey with two such strong partners to unlock the potential of the digital asset universe for institutional market participants – and ultimately spearhead digital assets’ transition from mainstream awareness to mainstream adoption. The establishment of a trusted digital asset ecosystem is also another strong example of Switzerland and Singapore’s continued leading role in global financial markets innovation.”