Unchained Capital, a bitcoin-native services company, announced the release of its new vault product. Unchained vaults use dedicated, on-chain bitcoin multisig addresses; which means users get to control who holds keys to these addresses.

The Unchained Capital website makes it easy to upload public keys, build new vault addresses, and coordinate transaction signing. Moreover, Unchained can cosign with the user if requested or if they lose one of their keys; still, users remain in control; what Unchained calls the collaborative custody model.

These new vaults integrate seamlessly with the company’s existing loans: once a user has funded a vault, if they are then looking to borrow against their bitcoin (or use a future product), it can be done so easily and quickly from within the web application.

How Unchained’s Vaults Work

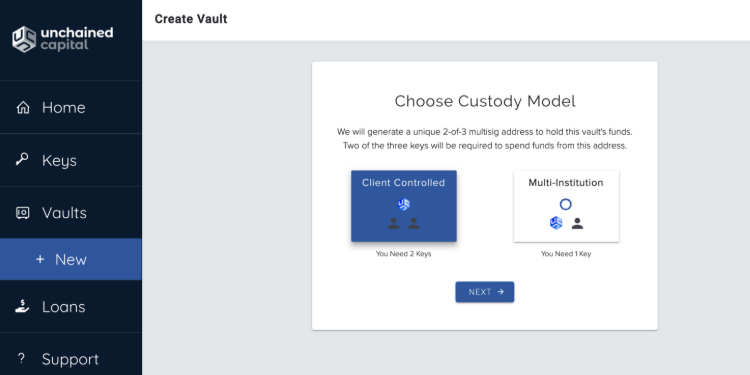

The vaults are 2-of-3 multisig addresses. This means 2 keys are required to move funds and 1 key serves as a backup. Within this structure, users have a lot of freedom to customize who holds keys, allowing for the building of a security model that is right for their specific use case.

Vault custody models

Unchained Capital offers two different custody models for its vaults:

Client-controlled – The user holds 2 keys, maintaining sovereign control of their funds. Unchained can act as either a backup or as a trusted cosigner, but cannot move funds without a signature from the user.

Multi-institution – Three separate parties each hold a key; no single party can cause your funds to move. All transactions will be signed by you and cosigned by Unchained Capital. A 3rd-party key agent (Citadel SPV) acts as a backup to both parties This is Ideal for institutions, family offices or investment funds that demand enhanced security and financial controls