LINE Corporation, the operator of the popular smartphone digital wallet service LINE Pay, announced today plans to introduce in Japan the LINE Pay co-brand credit card in partnership with Visa, the global leader in payment solutions.

Last year, LINE Corporation launched its first digital token, LINK, and its first blockchain network, LINK Chain, alongside opening a crypto-asset exchange, Bitbox.

The LINE Pay-Visa credit card is slated to be released later this year, significantly expanding payment options for LINE Pay users in Japan and accelerating the country’s shift to becoming a cashless society.

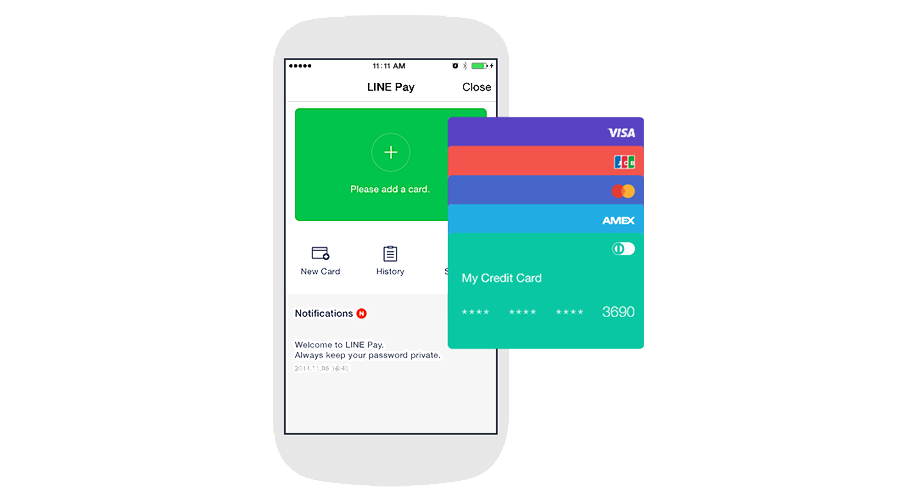

LINE Pay-Visa co-brand credit card users will be able to make payments at Visa accepting merchants throughout Japan and globally. Once a LINE Pay-Visa card has been registered to a LINE Pay account, they will be able to continue using LINE Pay at accepting merchants through their smartphone screen, without presenting a physical card.

Unlike the prepaid LINE Pay Card, the LINE Pay-Visa co-brand credit card will enable users to make purchases using their credit line, without needing to top up the balance of their LINE Pay Wallet.

“As LINE Pay has grown, our top priority has always been providing the best possible user payment experience,” said LINE Pay CEO Youngsu Ko. “We believe the launch of the LINE Pay-Visa co-branded credit card will greatly improve the entire LINE Pay platform, adding a diverse range of easy-to-use features and driving a significant increase in users.”

In addition, the LINE Pay-Visa co-branded credit card will offer users a range of exclusive rewards for using the card, including the LINE Points program. Users will gain LINE Points for their spending, in combination with “My Level,” a tiered incentive program offering bigger benefits for the most active LINE Pay users.