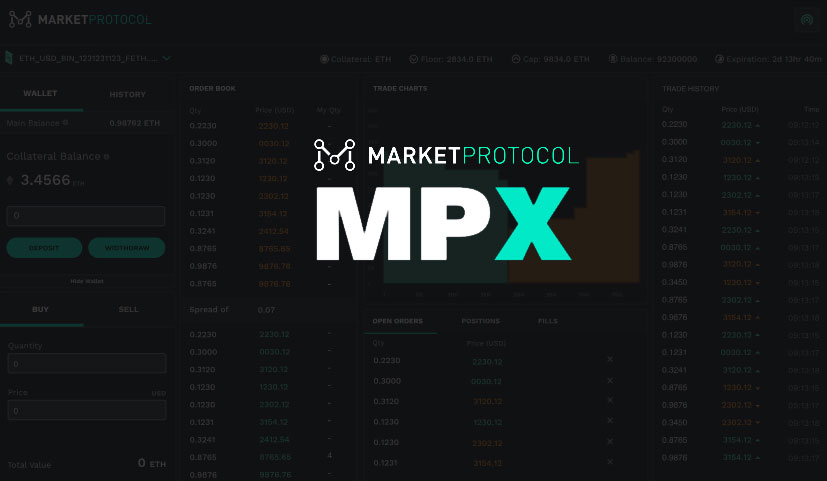

MARKET Protocol, a decentralized framework allowing derivative trading of all assets, announced today the beta release of their decentralized application (dApp), MPX.

This release of MPX provides users with a simulated trading environment on Rinkeby, an Ethereum testnet, allowing them to trade MARKET Protocol contracts against a bot. MPX is powered by MARKET Protocol which enables users to experience the benefits of derivatives on the Ethereum blockchain. Users are able to easily trade MARKET Protocol contracts to go long or short crypto assets, hedge tokens, gain cross-chain price exposure to bitcoin, and much more.

“This is the first time users will be able to fully take advantage of trading decentralized derivatives on the blockchain. We are so excited for everyone to begin experiencing crypto trading the way we have always envisioned it,” said Collins Brown, co-founder of MARKET Protocol.

MPX highlights a number of features and capabilities made possible by MARKET Protocol. Users can trade new relationships not found anywhere else, like S&P 500/USDT or OIL/USDT. It’s also possible to trade with leverage, guaranteed stop loss execution, and known maximum downside prior to trading.

With MARKET Protocol, users will be able to trade the price of any asset, whether to hedge or speculate, without trading or holding assets spread across many exchanges. In addition, users always trade without centralized custody or counterparty risk, because all contracts are solvent and fully collateralized at execution. Together, these capabilities make for a more flexible, safe, and secure trading environment.

“This is truly just the beginning for MARKET Protocol – we have only scratched the surface in terms of what types of applications can be built using this framework,” said Brown.