MyCrypto, Inc., an open-source interface that simplifies the process of storing, sending, and receiving digital assets, announced today it has raised $4 million in a Series A round of funding led by Polychain Capital. With these new resources, MyCrypto aims to build and expand its consumer-friendly gateway for cryptocurrency users.

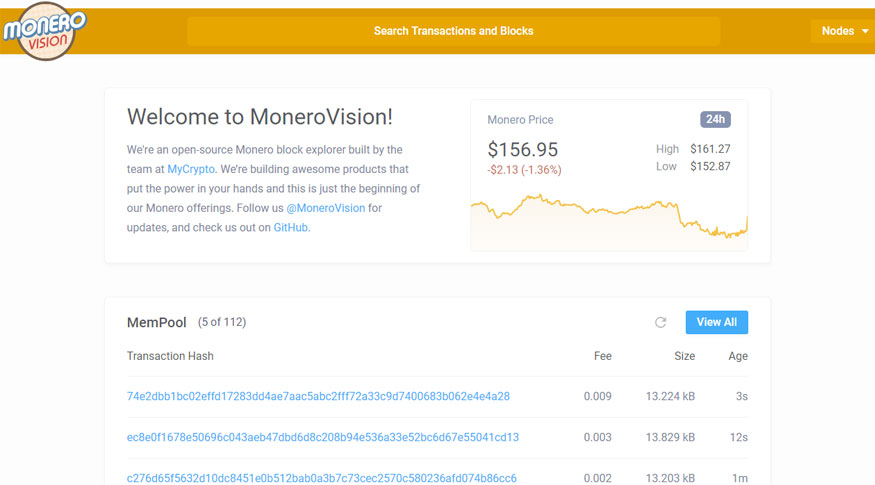

MyCrypto provides a suite of tools for users to create new wallets, send and receive, and buy and sell/exchange virtual currencies. In a move to make it easier for users to secure their funds outside of an exchange, MyCrypto recently launched a desktop app that will allow users to manage and use their cryptocurrency sans online services and protocols.

Polychain Capital, the world’s premier investor in cryptocurrency protocols and companies, led the Series A funding round in MyCrypto. Additional investors include Boost VC Fund 3 LP, Mainframe’s Mick Hagen, Chance Du (Coefficient Ventures), ShapeShift, Ausum Blockchain Fund LP, early Dropbox employee Albert Ni and Earn Co-Founder Lily Liu (4T Global LLC).

“We believe today one of the major bottlenecks to cryptocurrency adoption is the lack of an easy-to-use interface for average people. MyCrypto is led by hardcore cryptocurrency entrepreneurs and is well-positioned to onboard the next one hundred million cryptocurrency users.”

According to statistics and data from Etherscan, the number of unique Ethereum addresses surpassed 41 million this month. Further, according to Techcrunch, a large-scale survey by SurveyMonkey and Global Blockchain Business Council found that 46 percent of participants have heard of Ethereum and that around five percent hold bitcoin.

“The cryptocurrency market is always changing and evolving, which can make navigating and understanding it difficult and overwhelming for both new and seasoned users. We’re dedicated to designing an experience that can further simplify how people can access and store cryptocurrency and are thrilled to see the overwhelming support we’ve received from our partners, investors, and community.”