Coinbase, the US-headquartered bitcoin and cryptocurrency exchange company today announced that it will be reducing the annual management fee for its Coinbase Index Fund from 2% to 1% for all new and existing investors.

The reason for reducing the fee was simply to entice investors who are familiar with lower-fee index funds commonplace in other asset classes. Coinbase hopes the fee reduction will help introduce a new category of institutional investors into the crypto space.

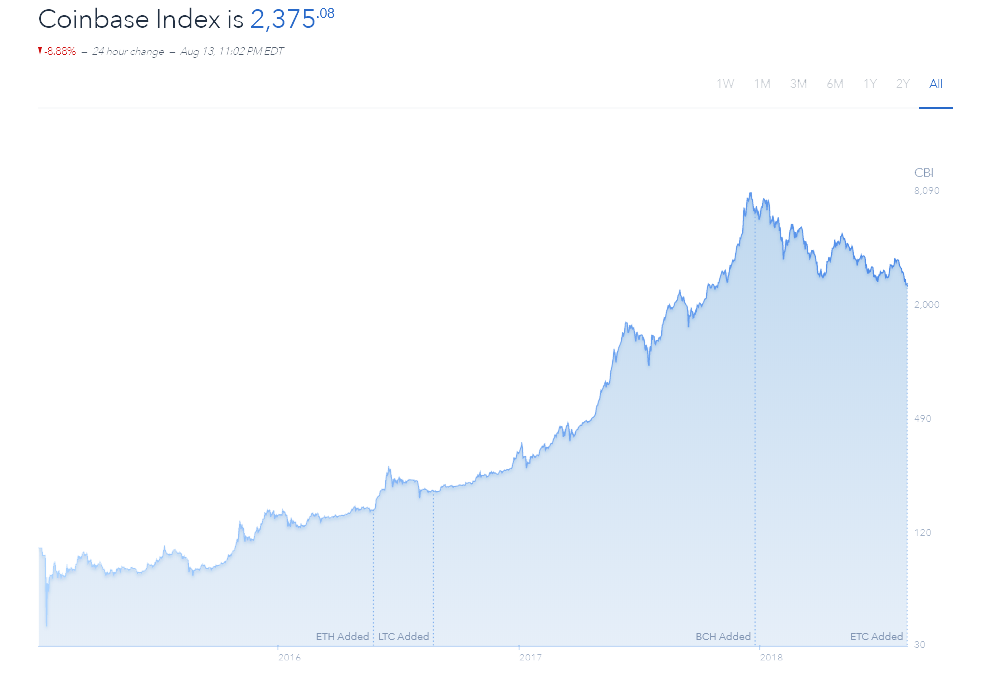

Adding ETC

Further, the Coinbase Index Fund has been rebalanced to include Ethereum Classic, following its listing on Coinbase this week.

All investors of the Fund now have exposure to Ethereum Classic. The Coinbase Index plans to continue this method of adding new assets to the Index after they are officially listed on Coinbase. Coinbase recently declared they are exploring Cardano, 0x, BAT, Zcash and Stellar blockchain assets for listing.

Officially incepted on May 1st, 2018, the Coinbase Index Fund gives investors exposure to all assets listed by Coinbase, weighted by market capitalization. At this stage, the fund is open to US residents who are accredited investors. The minimum investment is $250,000 and the maximum is $20 million.