Crypto Credit Card (C3) a platform that monitors and aggregates the best credit and crypto credit offers around the world and allows managing of funds on top crypto exchanges and investment platforms currently in the middle of its token presale, will launch a full token sale next month starting on December 4th.

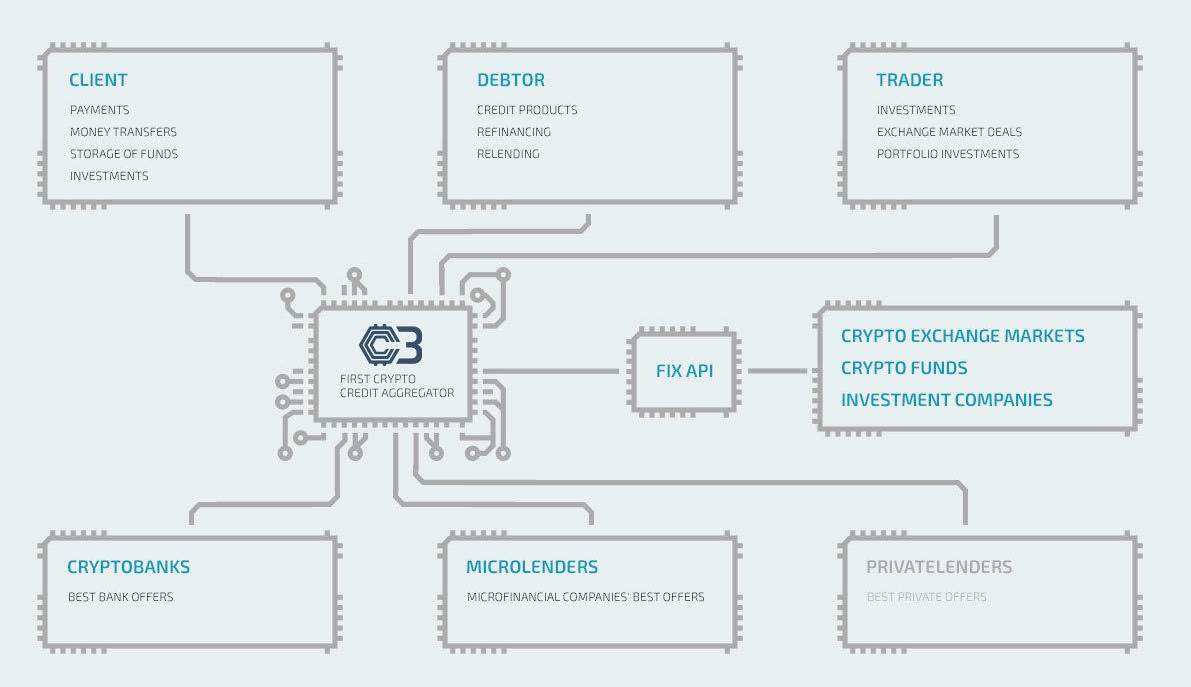

The C3 Platform provides an opportunity to pick up a credit offer with optimal interest rate or use all accepted limits approved by banks expanding and managing thus the pool of available limits with free interest period of credit limits up to 60 days. Credit products of the platform include traditional consumer crediting, ‘crypto crediting’ or obtaining a loan in fiat supported by cryptocurrency on the C3 account and microloans.

Traditional consumer Crediting

Banks will be able to grant loans on the basis of blockchain technology smart contracts, which will allow them to reduce costs and simplify accumulation of information about the solvency of the clients. The clients will be able to obtain loans on the most favorable terms by choosing the most optimal credit product or by using all credit limits that will be approved by banks, managing thereby a pool of their limits.

Cryptocrediting

Crypto crediting is the provision of a loan in traditional currency pledged by cryptocurrency on the platform account. This is an innovative solution in the credit market. Banks will be able to grant loans secured by cryptocurrency based on smart contracts even to the clients with a low credit rating or by reducing the number of procedures necessary to grant a loan on favorable terms and guaranteeing a minimum interest rate.

Microloans

Now on the market, there are many micro-crediting offers from banks and micro-financing funds. The platform will allow choosing the optimal solution for the client without going through additional procedures of solvency analysis. For banks and micro-financing funds, the platform will give access to an additional sales channel for their products.

Cryptocrediting is an innovative product on the market. The growth of cryptocurrency index rates will help to ensure almost non-interest-bearing use of credit funds. Crypto credits assure the lowest interest rate, allow to release funds from cryptocurrency to fiats for paying bills and simultaneously earn profits from the cryptocurrency pledged by using trust management services.

Investment Opportunities

Financing received in the form of consumer, micro or crypto credit on the platform is easy to invest in any cryptocurrency, ICO or fund. The platform will provide access to the global network of exchanges and investment platforms.

Multicurrency wallets allows to keep securely cryptocurrency, euros, dollars and domestic currency on the account in the Wallet, to exchange cryptocurrencies to fiats and vice versa with up to 2% commission rate, to replenish the account by any convenient tool, such as another payment card or internet wallet, and to transfer money to other users without commission.

Crypto Credit Card allows to pay the bills and purchases and to withdraw cash in ATMs all over the world. When paying for goods and services by Crypto Credit Card in major retail chains, restaurants and service centers up to 30% of the amount spent will be refunded. Cryptocurrency is also can be used for payments where only fiats have been accepted before. We plan to expand the number of partners that accept payments in cryptocurrency.

The World’s First Crypto Credit Aggregator with a Swiss Bank License

Decentralized principle ensures the highest level of protection and transparency of the platform, which enables banks and customers to cooperate on the basis of smart contracts, reduce costs, accelerate the launch of the new credit products and reduce the time for processing information and decision making.

Crypto Credit Card Token Sale

CCCR tokens will be released on the Ethereum platform in accordance with the ERC20 standard. The price of CCCR token will amount to $1 USA. 55% of tokens (110 million by volume) will be available for sale, and 45% of tokens (90 million) will be reserved for the company, team, bounty programs and promotion of the platform.

Presale of CCCR tokens will be held from 15 November 2017 to 29 November 2017. Crowdsale of tokens will be held from 4 December 2017 to 15 February 2018. If during the period of the ICO a minimum amount of funds of $1 million will not be attracted, all funds will be automatically returned to the owners of Ethereum-based smart contracts. All unsold tokens will be destroyed.

Bonuses granted for tokens purchase:

- from 15 November 2017 to 29 November 2017—38%

- from 4 December 2017 to 13 December 2017—23%

- from 14 December 2017 to 27 December 2017—15%

- from 28 December 2017 to 10 January 2018—9%

Crypto Credit Card Team

The team of the project consists of more than 40 experts in banking, credit products sale, blockchain solutions, and IT-developers. The key team members have more than 15 years experience in the development and sale of credit products.

CEO of the project, Sergey Salynin, is investor, successful entrepreneur, Vice-President of payment system solution company, Top-manager of several international banks. Advisors of the project are investors and entrepreneurs in blockchain, legal and compliance, banking, finance, and investments management fields.

More information can be found in the CCCR whitepaper.

[embedyt] https://www.youtube.com/watch?v=OFEXflApdqw[/embedyt]