AirSwap, the ER20 token protocol for the decentralized trading of Ethereum on a global network announced its second product, Token Trader, an end-to-end implementation of the Swap Peer and Oracle protocols.

The product will allow AirSwap to solidify the trading experience for both market makers and traders. A strong token trading network, providing liquidity, connectivity, and reach, starts with a plug-and-play ecosystem for market makers to push trade flow through friendly frontends.

December 5th beta launch

The AirSwap team said that following a development sprint it will be running the full stack internally to stress test, watch the logs, and squash bugs. They are looking to start a testnet beta on December 5th with around 40 traders, and upon success, open the beta to the rest of the community.

Token Trader equips market makers and bootstraps liquidity on the AirSwap network, positioning for an expansion into a marketplace and wider partner network throughout the next year.

Features include:

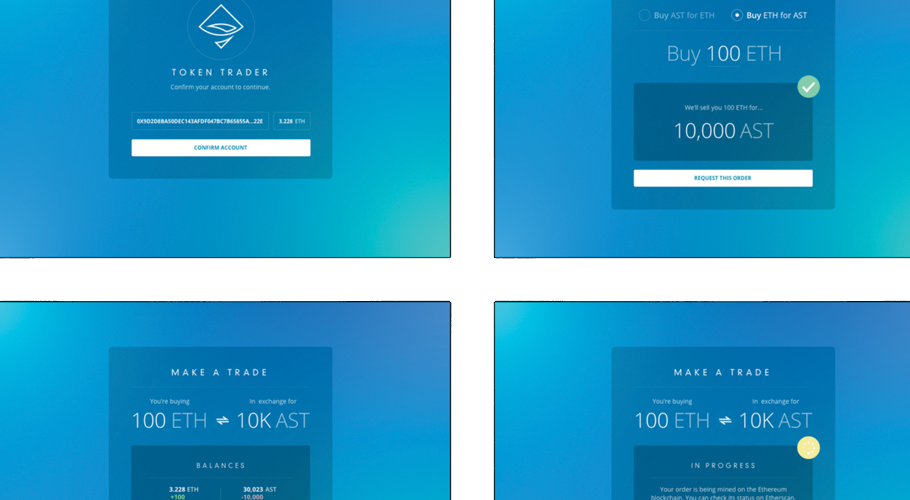

- Market Maker – The market maker provides orders based on its valuation model and serves a dashboard to help operate it. Today the maker offers the AirSwap token (AST) for ETH and ETH for AST.

- Router – The router transmits messages between the market maker and taker frontend. Later, AirSwap will offer more options including client-server and peer-to-peer. The router is written in Elixir and the Phoenix framework.

- Oracle – The Oracle provides price data to smooth the process of making and taking orders. On the frontend, a taker is able to verify the price they’ve received. Today, the oracle provides this data as an aggregated order book.

- Taker Frontend – The taker frontend is a web application that requests and fills trades received from the market maker. The frontend will feel like a ShapeShift for Ethereum tokens and is written in React and Redux.