ICONOMI, the blockchain-based digital asset management platform allowing anyone from beginners to experts to invest in and manage a portfolio of digital assets today announced that blockchain and investment luminaries William Mougayar, Arnold Sternberg, and Kenny Hearn will be among the first in its series of Digital Asset Array (DAA) managers. The ICONOMI platform was fully opened to the public for registration on August 1, 2017. Since then, over 24,000 users have registered, depositing $101.6 million USD into the platform.

On release of the platform, ICONOMI introduced Columbus Capital as the first announced DAA managers, managing Columbus Capital Blockchain Index (BLX), a DAA representing a majority of the total market capitalization of all digital assets, and Columbus Capital Pinta (CCP), an actively managed, high-performance DAA. Since launch, almost $10 million USD has been invested in BLX.

ICONOMI Co-Founder and CEO Tim M. Zagar said:

“ICONOMI is proud of what we have achieved in just twelve months, especially given the pace of other ICO projects in the crypto-economy. Today we welcome the highest caliber investors in the world of blockchain to join us and manage the first cadre of DAAs.”

“The carefully chosen group was selected from a pool of 150 applicants from all over the world, each of whom exceeded the most rigorous criteria, showcased deep knowledge and foresight in their proposed investment policies, demonstrated an understanding of optimal portfolio structures, and came armed with strong track records to substantiate their theoretical expertise.”

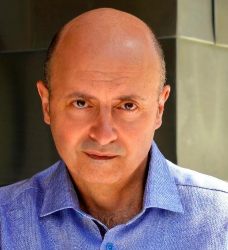

William Mougayar currently serves as General Partner at Virtual Capital Ventures (VcapV), a boutique-style, early-stage technology venture capital firm focused on decentralized peer-to-peer technologies and applications. Mougayar also serves as Senior Advisor to Cofound.it, a platform for nurturing promising blockchain startups.

Mr. Mougayar continued:

“It is a privilege to join ICONOMI as one of the first twelve new DAA managers joining Columbus Capital. Those of us leading the vanguard will begin to bridge the gap between the traditional financial world and the crypto-asset space.”

“The ICONOMI platform uniquely allows the creation of value from blockchain, professionalizing the world’s fastest growing industry by attracting talent and interest from the best of the institutional and tech worlds.”

Joining Mougayar as ICONOMI DAA managers are Arnold Sternberg, Managing Director of Cosmic Capital Holding GmbH, and Kenny Hearn, Director of Asymmetry Asset Management.Arnold Sternberg has vast financial experience, working previously with companies such as Goldman Sachs and the Allianz Group. A serial entrepreneur, Arnold co-founded ProFounders, Kammerlander Sternberg & Cie, Vermögensverwaltung GmbH, and Aeris CAPITAL AG (now Calibrium AG).

Arnold Sternberg has vast financial experience, working previously with companies such as Goldman Sachs and the Allianz Group. A serial entrepreneur, Arnold co-founded ProFounders, Kammerlander Sternberg & Cie, Vermögensverwaltung GmbH, and Aeris CAPITAL AG (now Calibrium AG).

Arnold Sternberg commented:

“ICONOMI piqued my interest a little over one year ago while I was investigating efficient solutions that enable investors to access the quickly emerging blockchain industry. I decided to closely monitor ICONOMI’s progress and, having met with their team, I became a great admirer of the project. I feel honored to have been chosen to oversee and launch ‘Kryptonite CORE,’ my DAA, as one of the first DAA managers. I am excited to be part of ICONOMI and its expanding functionalities, community, and ecosystem.”

A longstanding member of the financial community, Kenny Hearn has worked previously with companies such as Morgan Stanley, Barclays, Barnard Jacobs Mellett, and Coronation Capital.

Kenny Hearn’s comments:

“As the world of finance adjusts to modern-day innovation, ICONOMI is not only looking to the future but leading the way. I am delighted to be among the world-class experts in blockchain, finance, and crypto-assets that were carefully selected to become ICONOMI’s first DAA managers, and I look forward to contributing to the success of this project.”

![]()

With unique and intuitive tools, ICONOMI enables users to invest in and manage various digital assets and combinations of digital assets called Digital Asset Arrays on a global scale. Committed to setting industry standards, ICONOMI was among the first to utilize a vesting schedule for tokens after its ICO. On Friday, September 29th, ICONOMI marked its first year in business.