Yesterday on August 8th, 2017, the GoldMint project launched to provide gold ownership solutions for cryptocurrency investors. Physical gold is an age-old method of payment and wealth preservation. Owning gold, however, requires expensive security, safekeeping, and insurance, in addition to being illiquid. GoldMint’s modern solution to these inherent problems is GOLD, a 100% gold-backed token.

This past May, GoldMint already successfully ran it’s pre-ICO raising $600,000 in just 36 hours.

Gold & MNT Tokens

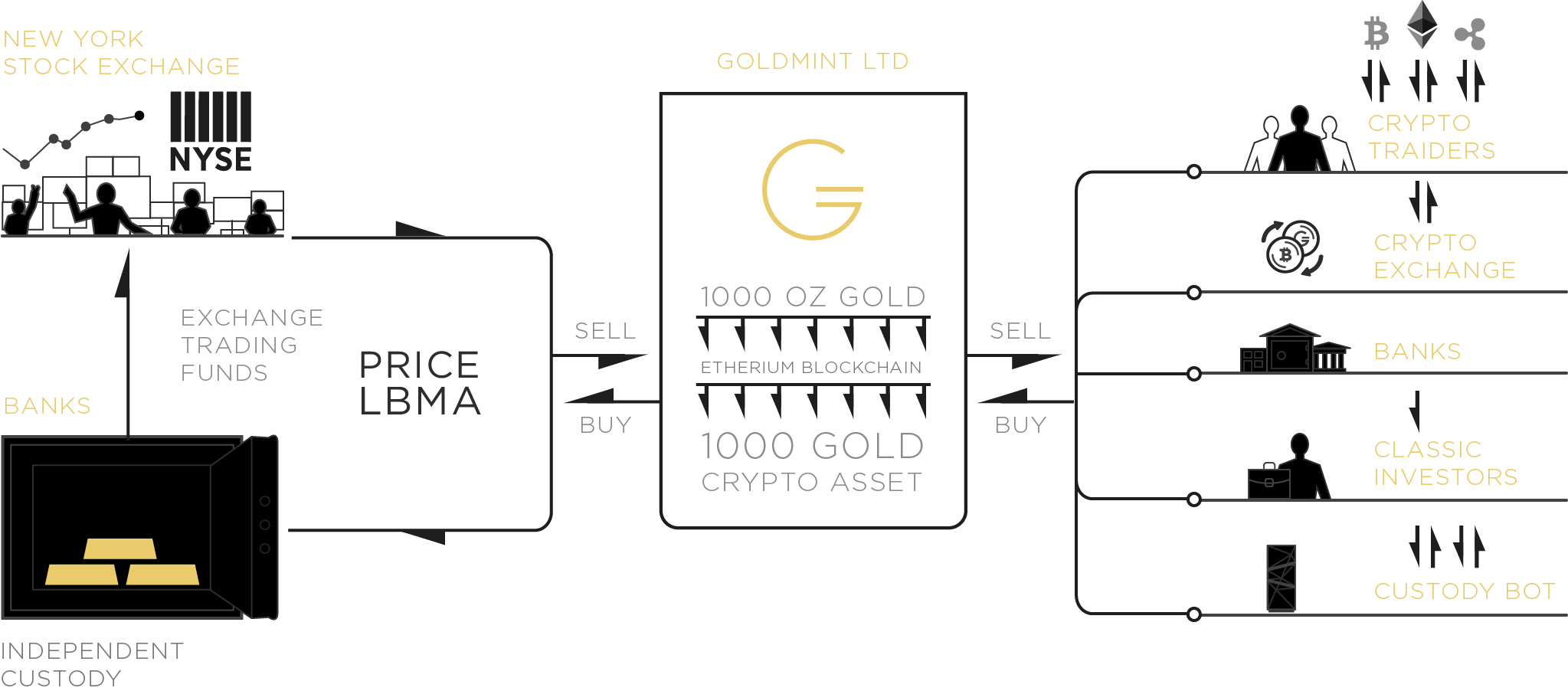

Taking all of the security advantages of its yellow metal counterpart, GOLD tokens are a stable, transparent and non-volatile means to hedge your crypto portfolio from wild market swings. GoldMint will ensure the coins value with physical assets as well as paper assets such as ETFs. Additionally, GOLD holders will be able to use their tokens in guarantees, loans, and escrow services. GOLD will be subject to a 5% purchase and 3% sale fee.

1 GOLD crypto-asset is supposed to equal 1 real OZ of physical gold LMBA.

GoldMint will also release MNT, its utility token used for operations, implementation of smart contracts, and for rewarding block creation and transaction confirmation. For facilitating the blockchain, MNT owners will receive 75% of the commissions taken from processing GOLD transactions. Initially, MNT will be sold and distributed on the Ethereum blockchain. After MNT is distributed, GoldMint will launch its own PoS blockchain based on Graphene. Thus, it will be safer, more productive and faster.

Cutting-edge Blockchain Integration

GoldMint will incorporate several technological advancements into its project: Custody Bot, the Graphene based blockchain, and its own custom API. Custody Bot is a blockchain connected robot programmed for inspection, temporary and long-term storage, and transfer of physical gold, jewelry, coins, or gold bullion. The unit will be installed in small banks, non-credit financial institutions, and pawnshops, as well as used by private individuals. When an item is placed into the Custody Bot, it conducts analysis using a spectrometer and state of the art weighing system and then stores information about weight, quality, and value on the blockchain.

For merchants and developers, GoldMint will release its API for the development of third party apps and other interfaces. Use of the API will allow online stores to take GOLD as a payment method, enable loans to be secured by banks and other Monetary Financial Institutions (MFIs), and also implement other services such as escrow accounts and financial guarantees.

The Goldmint Team and Advisors

The GoldMint team is led by Dmitry Plutschevsky, co-founder of Lot-Zoloto, a gold trading company based in Russia with a trading turnover of 100$ mln in 2017. Among the advisers to this project are Serg Umansky, founding partner at SIGNET; Alex Butmanov, managing partner at DTI; Igor Ryabenkyi, managing partner at Altair VC, and Julian Zegelman, managing partner at Velton Zegelman.

Julian Zegelman, Goldmint Advisor stated:

“I like the project team and their vision of becoming the first and largest player in the gold tokenization market as one of the benchmark financial assets.”

The GoldMint project will serve all gold investors looking either to hedge their portfolio with GOLD or earn a return from facilitating the network with MNT. GoldMint founders predict that, in five to seven years, gold will be stored in, traded, and invested using machines like Custody Bot, and that the GOLD crypto-asset will become the trading unit for these operations.

For more information on Goldmint see the project’s website and blog or they can also be reached by email.