Node40, the blockchain tech company which offers Software as a Service (SaaS) for tax compliance to American cryptocurrency users, has now launched bitcoin support on its popular Node40 Balance solution. The new service comes just four months after the New York company introduced blockchain accounting software for Dash users.

The addition means every single bitcoin user across America, now estimated in the tens of millions, can accurately report their gains and losses to the Internal Revenue Service (IRS) without fear of tax evasion, underreporting, or overreporting.

The product is expected to be a welcome reprieve for the growing list of bitcoin traders, especially Coinbase users, who until now, have had very limited options for reporting gains and losses to the taxman each fiscal year.

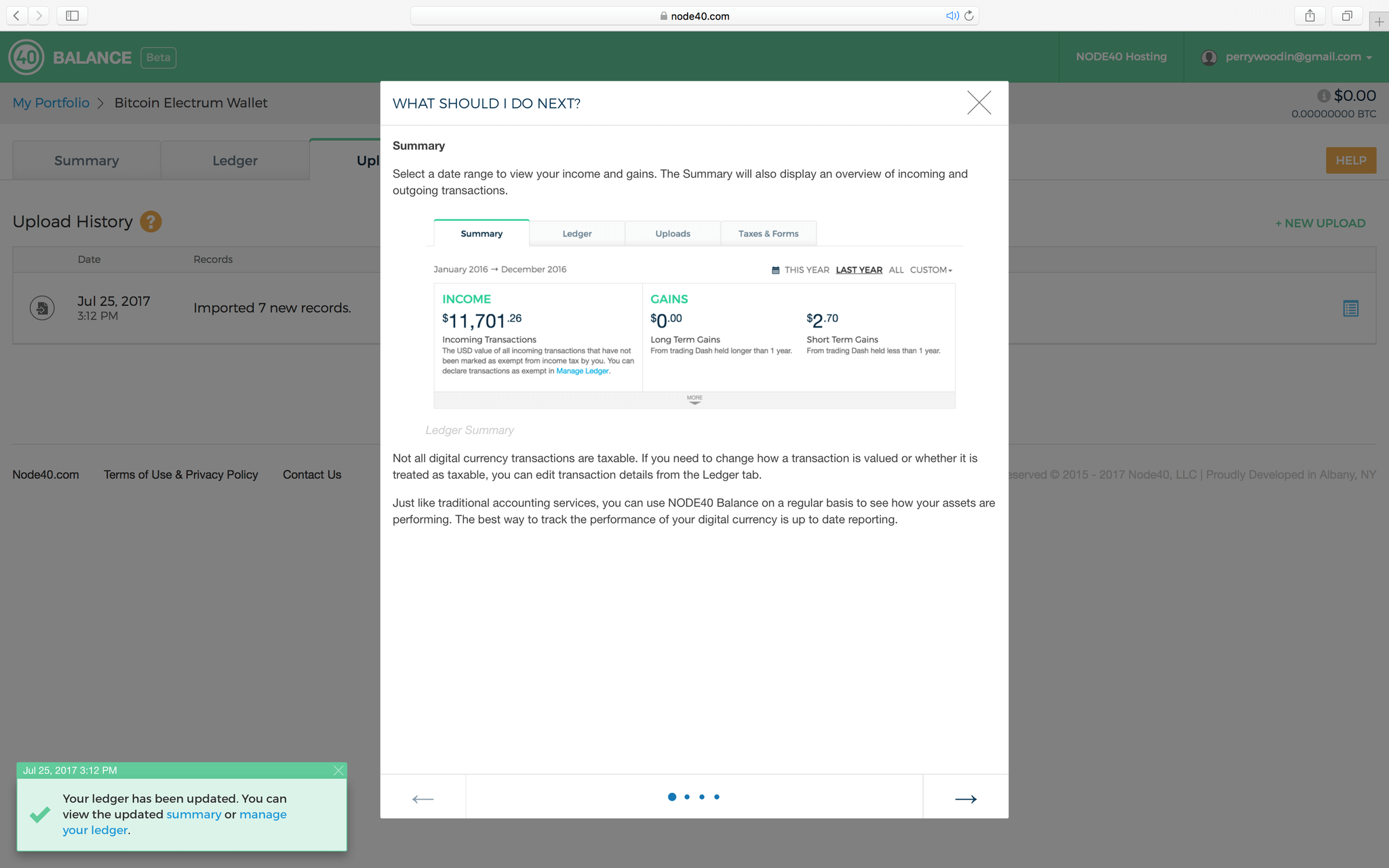

Node40 Balance allows users to conduct accurate tax compliance using intuitive, easy-to-use software that analyzes the blockchain, calculates exact net values from each transaction, tracks the cost basis and days carried, and rolls the data into IRS Form 8949.

Perry Woodin, CEO of Node40 said:

“Not only is blockchain accounting inherently complicated, it’s currently under heavy legal scrutiny. Since the IRS considers digital currency property, each and every input to a transaction has a potential gain or loss. Tracking the cost basis and days carried on every input to a transaction is simply not possible without sophisticated software. Nobody wants to think about gains and losses when purchasing goods or services, much less manually record transactions in a spreadsheet for future record keeping. Node40 Balance allows digital currency owners to use the blockchain as the public ledger it was always intended to be, and provides users with the most accurate data for their reporting obligations at tax time.”

“The IRS Coinbase summons motivated Dash owners to use our service and get their records in order for the 2016 tax season, and Bitcoin owners have well and truly been put on notice. The voluntary compliance rate for United States citizens is over 80%, which makes it obvious that most people take reporting their tax liability seriously; we believe bitcoin users haven’t had the right tools available yet. If the industry wants digital currency transactions to become commonplace, an integrated service like Node40 Balance is essential. It validates the legitimacy of a new, complex form of transacting, and compliance is crucial to bringing a new technology into the mainstream.”

Given the ongoing Coinbase vs IRS lawsuit, heightened probes into cryptocurrency tax evasion and the fact that only 800 Americans reported their bitcoin gains from 2013 through 2015, there’s never been more timely help for cryptocurrency users.

The method previously used by bitcoin traders to report their gains and losses was either through a painstakingly slow manual process or the highly inaccurate First In First Out (FIFO) method which should not be applied to transactions ex-post facto.

Woodin continued:

“The problem with FIFO is that it needs to be applied at the time of the transaction. People should really be creating transactions where the inputs are FIFO; it simply doesn’t work to apply FIFO after the fact. While some services are geared towards one-off taxation reporting, Node40 Balance aims to be a consistently accurate platform that tracks performance and reports on gains, losses, and income throughout the year. All users need to do is upload their transactions, await the calculations, and then send the resulting Form 8949 to the government when they file.”

“Even as digital currency matures and more mainstream investors jump aboard, we believe that bitcoin will permanently remain a form of property, as per notice IR-2014-36. What this means is that reporting bitcoin tax liability is an individual legal responsibility under the ‘Sale and Disposition of a Capital Asset,’ and Americans need a long term, reliable, cost effective, and most importantly, IRS-friendly solution. We are proud to finally bring that solution to market.”

Currently, Node40 Balance’s bitcoin service is available for Electrum wallet users, with new wallets soon to be added across the coming months (Exodus and Trezor are next in line for integration). Access to Node40 Balance is free during its beta period and the paywall has been removed to optimize customer feedback until Q4 2017.

In its current form, Coinbase users will need to transfer their bitcoin to an Electrum wallet before reporting with Node40 Balance.