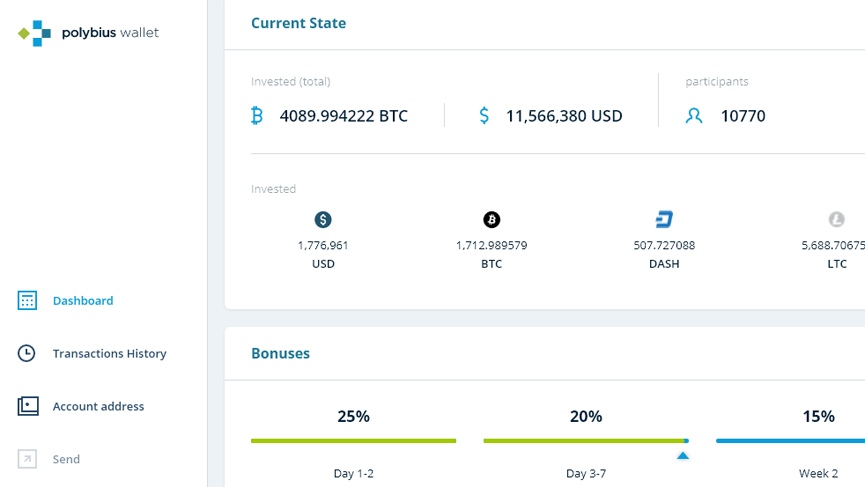

The Polybius digital bank project has raised enough in its ICO, which began last week, to now qualify and register as an EU banking institution. The USD $6 million EU bank milestone required was reached just three days after the ICO opened on May 31st.

According to the Polybius, this will be sufficient to obtain a full banking license and to launch the bank in an EU country, the project has already scouted and set up a base in Switzerland.

The Polybius project, established by the Estonian company Polybius Foundation, started out in response to the opportunities created by modern European legislation. It is firmly targeted at developing the financial technologies sector both in the European Union and in Switzerland. Specifically, it is now possible to use blockchain as a basis for documentation and for recording bank transactions.

Other innovations Polybius Bank plans to include is the use of specialized artificial intelligence for crediting, and Digital Pass, a digital identification technology. Digital Pass is a secure digital substitute for using physical documents for identification, where personal presence is required.

New EU legislation allows a project such as a universal digitally based bank which can function within a legal framework to be brought to life for the first time.

When Polybius Foundation’s ICO has concluded, Polybius Bank’s country of registration will be announced. The team says the choice right now comes down to Lithuania, Luxembourg, Finland or Switzerland.

The successful start to Polybius’ ICO confirms the project’s calculations about the demand for a financial institution which can serve as a bridge between the crypto world, with its super-high speeds, and modern banking, with all the rigor of its legislation.