It was reported from ICONOMI, the digital asset management platform with a unique offering where anyone can become a DAA (Digital Asset Array) manager that the book value of its investments at the end of Q1 2017 reached $21,605,453. This represents an approximate 106% increase since the initial ICN token distribution.

The revenues made in Q1 2017 measure $50,936.

Note: the book value of ICONOMI includes current ICNP assets.

These revenues consist of:

- ICNX — Passive DAA entry/exit and management fee: $589

- ICNP — Managed DAA profit fee: $49,650

- ICN token withdrawal fees: $697

Repayment Program

In Q2 the company started its repayment program using 1000 ETH, this equals 20% of the realized profit from ICNP from Q1. ICNX is currently in beta, however, ICONOMI has collected $589 in fees (representing a management fee on underlying assets of 3% per annum) and an entry/exit fee on every transaction (0.1%). There are further revenues in this period from ICN token withdrawal fees — every withdrawal from the ICONOMI wallet incurs a 1 ICN charge.

Internal Transaction

ICONOMI sold part of its BTC position in March (1000 BTC). Its average selling price was 1,197 USD per BTC. ICONOMI also acquired 8,077 Byteball tokens with minimal costs of 0.0006 BTC (less than 1 USD). Note: these are separate to a further 6400 Byteball tokens which exist within ICNP.

ICNP — Managed DAA

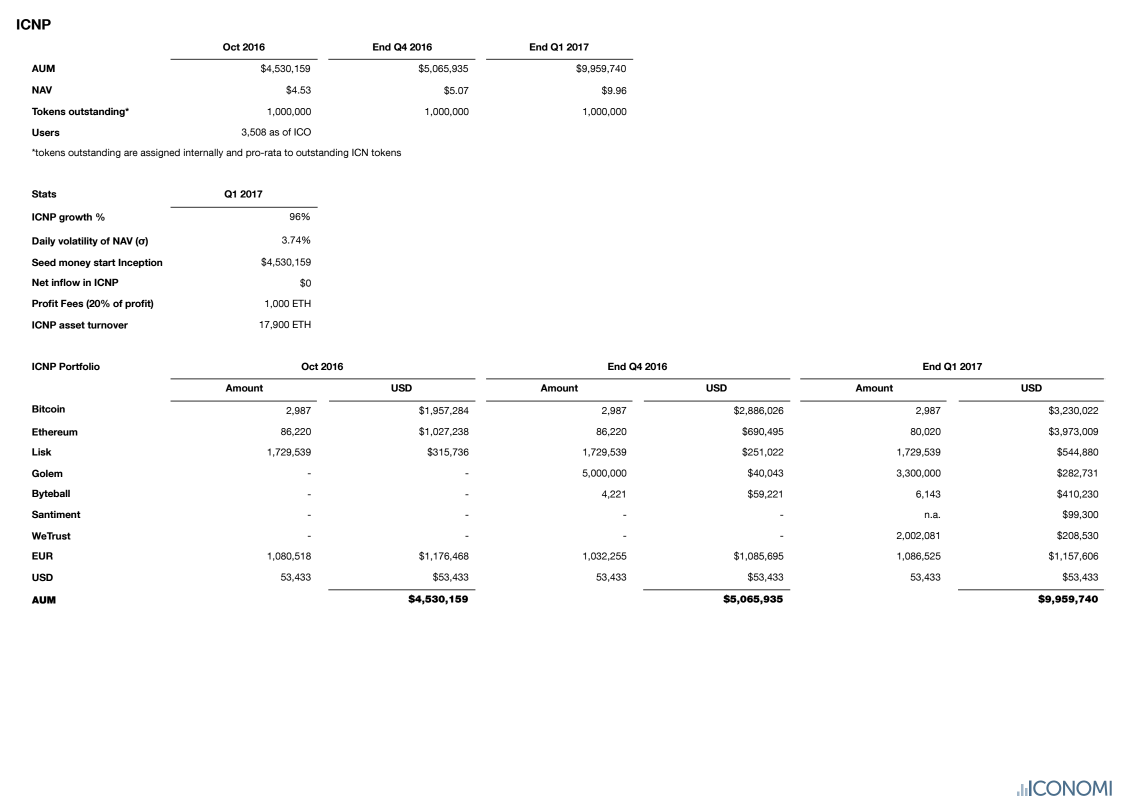

ICNP was established immediately after the ICN token distribution. Its book value at that time was $4,530,159 and corresponded to all funds raised above a threshold of 10,000 BTC during the initial ICO. Internally ITCONOM assigned 1,000,000 tokens to ICNP in order to follow its price per token more easily. This gave an initial price per ICNP of 4.53 USD.

At the end of Q1 2017, the price per ICNP is 9.96 USD. Note that ICNP is a closed-end Digital Asset Array (DAA). 80% of all ICNP profits are reinvested and as such, there is no dilution.

The assets under management within ICNP at the end of Q1 measured $9,959,740. This is an increase of 120% since inception — this was largely helped by the appreciation of uninvested assets such as bitcoin and ethereum.

ICONOMI made two ICNP portfolio investments within Q1 with Santiment and WeTrust. The company also closed approximately one-third of its Golem position leading to a profit of 5,000 ETH.

![]()