Token-as-a-service (TaaS) has announced it has incorporated its cryptocurrency portfolio management and analytics platform company, Kepler Technologies LLC, in Zug, Switzerland. The platform, Kepler, will be developed using a portion of funds raised from the TaaS Initial Coin Offering (ICO), which has raised more than $5.5 million, with three days remaining to invest before it concludes on April 27th.

Token-as-a-service (TaaS) has announced it has incorporated its cryptocurrency portfolio management and analytics platform company, Kepler Technologies LLC, in Zug, Switzerland. The platform, Kepler, will be developed using a portion of funds raised from the TaaS Initial Coin Offering (ICO), which has raised more than $5.5 million, with three days remaining to invest before it concludes on April 27th.

Investors in TaaS’ ICO will benefit from one year of free access to Kepler. TaaS is also announced that Financial Risk and Fund Specialist Patrick Salm has been appointed the company’s Managing Director.

Kepler Technologies has established headquarters in BusinessPark Zug, which is supported by Zuger Gründerzentrum, a non-commercial association dedicated to helping startups to innovate. Kepler Technologies will commence operational activities immediately following its publication in the Swiss Official Gazette of Commerce (SOGC) and its entry in the Swiss Commercial Register, milestones expected within weeks.

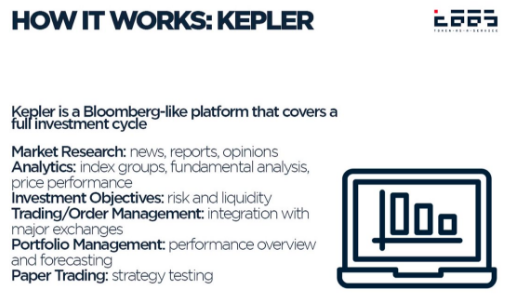

Kepler, a cryptocurrency investment platform similar to a Bloomberg terminal, will cover the entire spectrum of the investment process, from market research, due diligence and order management to risk exposure and performance forecasting. Kepler will offer a range of services for cryptocurrency investors, including market research, analytics, and portfolio management.

Its market research includes an audit of each cryptocurrency and token, including measurement of its likeliness to succeed, as well as a comprehensive catalog of news articles, blog posts and opinion pieces about the blockchain space. As part of Kepler’s analytics, TaaS will provide quantitative tools that examine the fundamentals and technical assets of digital currencies. These can include hashrate graphs, price performance and indexes, volatility measurement, and transaction volume, and are designed to maximize data-driven insight into the cryptocurrency market.

Kepler will also help investors set individualized goals, defining risk limits and performance expectations to understand their assets. The platform will also help with formulating a realistic timeframe to reach investment goals and optimal portfolio distribution. Additionally, Kepler investigates assets’ liquidity to predict a range of scenarios, from extreme highs to lows.In order to help investors maintain a diverse portfolio, Kepler is designed to be fully integrated with major exchanges. It also provides portfolio management services, explaining to investors short-term risks and outlining portfolio forecasts in the short- to mid-term. Kepler will offer the option to conduct “paper trades,” an opportunity to test-drive different investment strategies without risking actual capital. It is geared toward those who are curious about cryptocurrency markets, but who are not ready to include them in their portfolios.

Mr. Patrick Salm, the newly appointed Managing Director of Kepler Technologies is a financial Risk and Fund Specialist brings more than four years’ experience in blockchain technology.

He has also held leading roles with global banks. Currently, Mr. Salm serves as Strategic Risk Manager and Business Analyst at BANK-now AG, a Credit Suisse Group subsidiary, where he provides analysis and optimization of risk-relevant business processes and applications.

Previously, he was Head of the Pre-Legal Recovery Team at BANK-now, where he was responsible for monitoring risks and progress of loss-bearing positions for more than $150 million in assets. Additionally, Mr. Salm held leadership positions at credit card bonus company Jemoli Bonus Card and at Intrum Justitia, Europe’s leading credit management company.