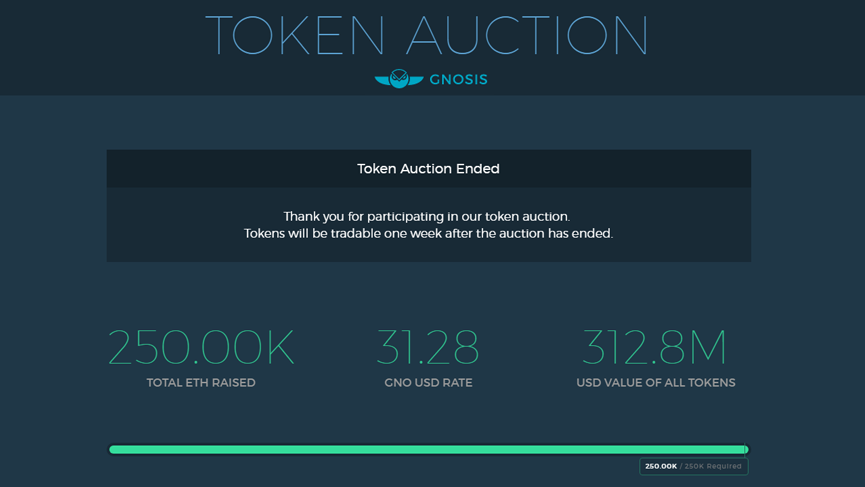

Gnosis, a decentralized prediction market running on Ethereum has completed its ICO in just 12 minutes with some stellar statistics. Tokens will be available for trade one week from today. In total 250K ETH was raised, the GNO/USD rate stands at 31.28, and 312.8 million in the current USD value of all tokens.

However, the free-floating market capitalization for GNO is $12.5 million with 400,000 GNO tokens sold at $31, the developer holds 9.6 million GNO tokens (99% supposedly locked for 1 year).

The largest portions of funding will be used for platform and application development, with approximately 42% of funding going to each. Additionally, approximately 4% will be used and held for legal purposes, and 12% for marketing and business development.

Basics of the ICO

Gnosis launched with the creation of 10 million Gnosis tokens (GNO) and a percentage of them will be distributed through the token launch.

Participants were able to send Ether to a token launch address, committing to buy GNO at or below the current price at the time of their purchase. The price of GNO will be determined by a falling, as compared to the current trend of rising, price specification.

The price of GNO will decrease every block that elapses during the launch. The price per GNO sold in the final block, when either ending criterion is satisfied, is the price that will be applied to all preceding sales during the launch period.

Example user experience

For example, Gnosis creates 10M tokens and begins the token launch. Alice sends 1 ETH to the token launch address while the rate is at 1 GNO for 0.2 ETH. The token launch process continues, with the price per GNO lowering each block.

$12.5M USD worth of ETH of GNO is sold on the 6th day of the launch. On the ending block, tokens were sold at a rate of 1 GNO for 0.1 ETH. The token launch concludes, and every participant gets tokens equal to the amount of Ether that they sent, at the rate of 1 GNO for 0.1 ETH (the price when the ending criterion triggered).

Alice, who contributed 1 ETH on day one, would, therefore, receive 10 GNO, applying the final sale price to her 1 ETH purchase. Again, participants declare the maximum price they are willing to pay for GNO, but ultimately receive the lowest price that any purchaser pays for GNO as the final sale price is applied to all purchasers.