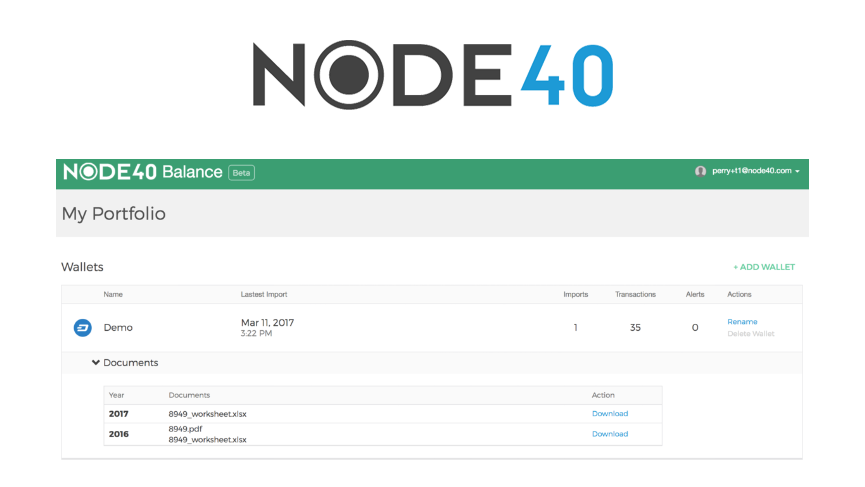

Node40, a blockchain infrastructure hosting service, has launched a software product that allows every single American to properly report their digital currency gains to the IRS. The product, called Node40 Balance is available for Dash users now and released to Bitcoin users later this year.

The service aims to set an industry standard by calculating net gains and losses for every single transaction made throughout the calendar year, and rolling it all into the IRS approved Form 8949 with attachable worksheets for the user; Node40 claims this is “an industry breakthrough” given the First In First Out (FIFO) method currently used by competitors often causes gross misreporting.

The continuing IRS summons of Coinbase for U.S. client identities on whatever suspicions shows that non-compliance is probably not the best option for serious business people and it’s time to start treating digital currency like you would any taxable asset.

CEO of Node40 Perry Woodin said:

“Node40 Balance is a feature packed blockchain accounting service that brings the familiarity of services like QuickBooks or TurboTax to the world of digital currency. Node40 Balance analyzes the blockchain and provides valuation data for all of your transactions. You annotate your transactions according to your real-world needs and Node40 Balance provides reports with your gains, losses, and income. What makes Node40 Balance unique is the precision in which gains and losses are calculated. A simple FIFO strategy is not sufficient for dealing with digital currency transactions. Node40 Balance uses the true carrying cost and days held to calculate precise valuations that ensure you are not over-reporting your tax liability.”

Node40 states the need for a professional product like this is broad for two simple reasons:

- Government direction for tax reporting digital currency has been ambiguous at best, given that the IRS policy for digital currency users was last updated in 2014. Although it is clear that digital currency is taxed as property, most people are unsure how to properly calculate gains, losses, and income from incredibly small fractions of currency with different valuations and different days held.

- Current means of tax reporting are categorically flawed; people currently self-report without taking minute-by-minute price fluctuations into consideration, or use existing software that favors aesthetics over accuracy.

Woodin continued:

“The burden of calculating tax liability falls completely on the user. Most people do one of two things; use software that does not calculate the level of accuracy that we required, or go to accountants who will apply a very simple FIFO strategy to determine gains or losses, which we know to be incorrect. This strategy works well for traditional investments where you are selling whole units, but it is not a good strategy for digital currency.”

“When transacting in digital currency, most transactions will have multiple inputs, each with a different cost basis. Unless you are able to create an exact transaction, the cost basis of the change needs to be tracked along with the number of days carried. Users of Dash and Bitcoin, both experiencing meteoric rises this year, have genuinely been crying out for a product like this for a long time. We anticipate significant demand.”