TradeBlock, a leading New York-based provider of institutional trading tools for digital currencies, today announced that major Chinese cryptocurrency exchange OKCoin will no longer be included as a constituent of the TradeBlock XBX Index.

The algo underlying the index already automatically reduced the weighting of OKCoin to near-zero based on recent market anomalies, minimizing the impact of OKCoin’s removal on any trading based on XBX.

As the crypto world knows, back on February 9th of this month OKCoin announced the suspension of bitcoin withdrawals from its exchange. This measure came as the People’s Bank of China has become increasingly involved in the activities of Chinese bitcoin exchanges over the last month.

OKCoin said that the suspension, planned for one month, will allow them to improve their anti-money laundering practices and their systems in order to prevent various types of illegal activities.

The announcement, which was followed by similar ones from other notable Chinese exchanges, caused the price of bitcoin to fall considerably across all major bitcoin exchanges in the succeeding hours.

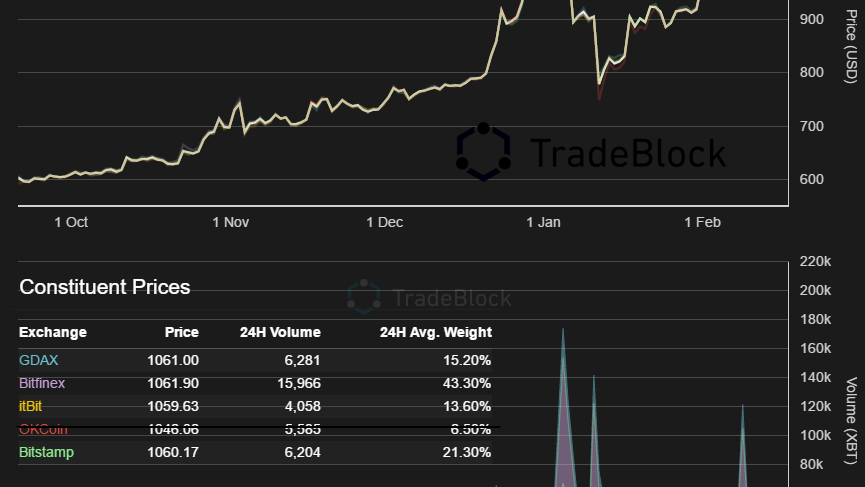

The following chart displays the effect that the announcement had on the bitcoin price as tracked by TradeBlock’s XBX index:

TradeBlock’s XBX index is designed to provide a reliable reference rate at all times without the need for human intervention by reacting to anomalies in real-time. As seen in this second chart below, XBX performed as expected by de-weighting OKCoin – from 10-20% normally to <0.1% recently – as its price trailed off from the rest of the cohort. As designed, the XBX index continued to offer a reliable reference rate for the price of bitcoin, even during a period of irregular activity.

Although the XBX algorithm mitigated the need for manual intervention, TradeBlock stated it is necessary to take into consideration its established criteria for exchange eligibility. An exchange with severe limitations does not form part of an accurate reference to the market price of bitcoin.

The XBX index provides an institutional, USD-denominated reference rate for the price of bitcoin. The XBX index tracks liquidity across individual exchanges and weights them according to their volume, price variance, and trading frequency. It also monitors and adjusts for deviations caused by anomalies and manipulation attempts.

The inclusion of any exchange in the index is guided by IOSCO principles for financial benchmarks.

More specifically, TradeBlock looks at the following criteria:

– A liquid market in the XBT / USD cross

– No restrictions on deposits and withdrawals of bitcoin and fiat currencies

– Reliable, real-time trade prices and volume accessible via API

– A publicly known ownership entity

– Compliance with relevant regulations

Although the XBX algorithm functioned as intended and mitigated the need for manual intervention, the sustained breach of a core principle for inclusion in the index warranted an exceptional review process says TradeBlock.

As such, OKCoin will be removed as a constituent of the XBX index over the next 24 hours. During the next XBX quarterly review in April, OKCoin’s eligibility will be reevaluated along with that of all relevant exchanges that could potentially qualify for inclusion under TradeBlock’s guidelines.