Gatecoin, the Hong-Kong regulated cryptocurrency trading platform for blockchain assets which back in May 2016 experienced a hack and theft of ETH and BTC (roughly $2m worth) has today provided an update on their repayment schedule. The company also provided updates on a variety of other recent actions taken plus plans to beef up the exchange through the launch trading CNY as well as expansion possibly into Japan.

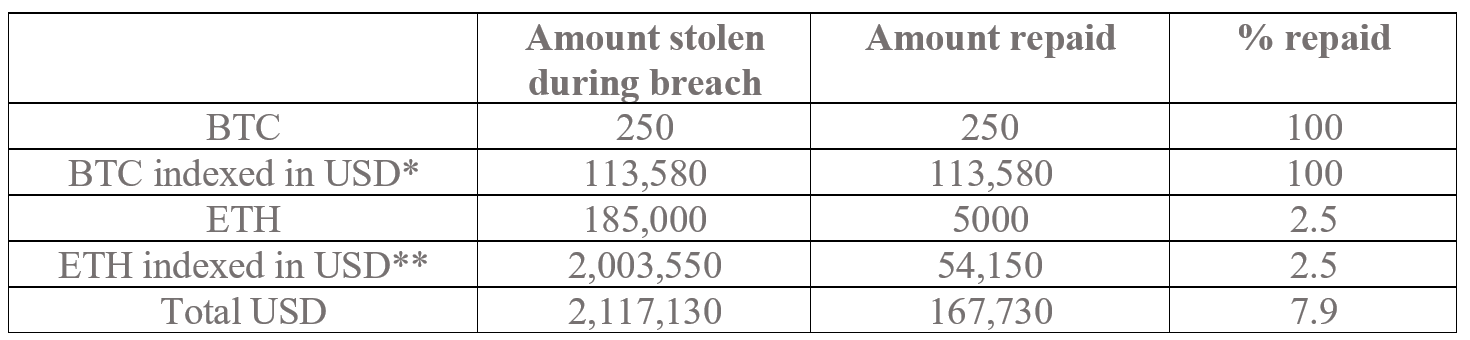

In addition to the ETH 185,000 that was stolen during the system breach, Gatecoin also lost BTC 250. This equates to a total of USD 2,117,130 based on May 13th, 2016 BTC and ETH USD prices.

Gatecoin stated they are aiming to allocate a significant share of profits to ETH debt (ETD), based on several revenue streams including:

Blockchain consulting services — reported to have already sold a blockchain based technical solution to a company in Asia and the revenue from this project has provided a buffer for operational expenses. This ensures that Gatecoin will be able to stay in business and invest resources in enhancing the exchange.

Exchange trading fees — despite modest trading volumes over the last few months, the engineering team has been working to improve the trading platform given the bugs that still existed following the exchange’s relaunch in August. These issues have taken time to fix due to the engineering team’s focus on delivering revenue generating blockchain consulting services. Confident that now these updates have been fully completed we will be able to recover and surpass the volumes we experienced on our exchange before the breach in May 2016. When volumes have reached significant levels, Gatecoin will begin allocating a growing share of trading fee revenues to ETD.

OTC trades — has already processed a handful of OTC deals worth several thousand bitcoin, with revenues from those trades currently contributing to operations. Reports to also have a steady pipeline of larger deals that should facilitate more frequent ETD repayments this year.

The table below demonstrates the amount and percentage the exchange has reimbursed since the breach as of February 15th, 2017:

*BTCUSD price on 13th May 2016 = 454.32 | **ETHUSD price on 13th May 2016 = 10.83

Highlights from the update:

- Gatecoin says they are currently working per its schedule to repay the next portion of the ETD within the next two months. All ETD holders will be notified by email when this repayment has been made as the company is unable to specify the exact date for now.

- From Q2 onwards, Gatecoin estimates they will be able to provide monthly repayments subject to the ability to grow revenues and build ETH funds.

- If ETH skyrockets in value and the ETH price rises considerably before the company can repay the full amount of ETD in ETH, its ability to reimburse will depend on the success of their revenue streams and is likely to take much longer.

- Not trying to raise funds from externals investors at this point.

- With the upcoming release of cryptocurrency exchange regulations in Japan later this year, Gatecoin is discussing with its Japanese investors on the possibility of helping to expand its presence in Japan by committing more funds. However, any additional investment from their side will not be used to repay ETD.

- After Gatecoin has grown revenues and paid off a considerable share of the ETD, the company indicated they may approach other investors for a series A round. The purpose of that investment would be to enable Gatecoin to acquire licenses in jurisdictions beyond Hong Kong and build up the engineering team.

- As mentioned by the team before regarding loans, an attempt to issue a convertible bond failed to garner significant interest among the investors so the exchange is no longer considering this as an option.

- Has tried applying for credit through other means, but given the niche nature of the business and the purpose for the loan in this situation, has not made much progress.

- No additional updates from law enforcement agencies or the exchange community regarding the status of the stolen funds and the hackers’ identities.

- Gatecoin will be meeting soon with the Hong Kong Securities and Futures Commission (SFC) to discuss the possibility of converting its ETD into equity in compliance with the current regulatory framework in Hong Kong. However, the existing consultation received suggests that this solution would not be legal and therefore unlikely.

- Plans to launch CNY trading pairs on the exchange by early April to ensure that the platform is fully optimized and compliant for usage by prospective clients in Mainland China. The exact launch date of BTC/CNY and ETH/CNY markets on Gatecoin will be announced later.

- Currently preparing to underwrite several ICOs and considering to list additional cryptocurrencies and blockchain tokens in the coming months.

Wrapping up, Gatecoin stated that aside from repayment notices, their next general update is scheduled for early May 2017.