ChronoBank, a blockchain-based initiative aimed at disrupting the short-term recruitment sector, has announced a partnership with Swiss based mobile wallet and trading platform Lykke , allowing users to trade ChronoBank’s tokens for other currencies.

ChronoBank, which is currently crowdfunding, has so far raised over 3,000 BTC (around $2.6 million USD) for marketing and development. It will connect employers with those seeking work. Employees will receive Labour Hour (LH) tokens, which can be bought and sold by companies to secure professional services, and by crypto traders who want to hedge their earnings in a stable, inflation proof token.

LaborX

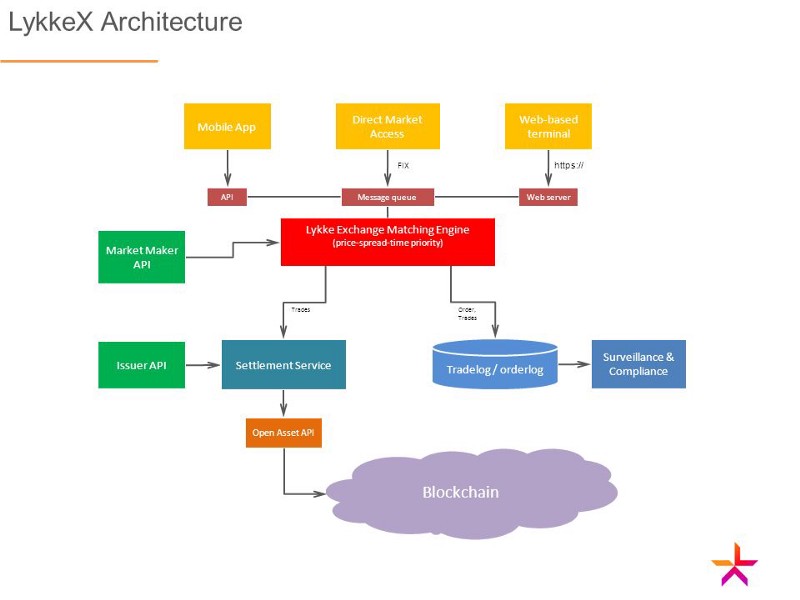

Trading of LH tokens, which will be issued on multiple blockchains, will take place on ChronoBank’s decentralised LaborX exchange. Both LH tokens and the TIME token, which will be distributed to ICO investors, will simultaneously be listed at the Lykke Exchange. Lykke, is a Swiss company dedicated to building a global marketplace for trading all classes of financial assets on the blockchain, will also be a strategic technological partner in the creation of LaborX.

CEO at Chronobank.io

Fintech partnership

Lykke, a digital exchange for all asset classes, was started by Richard Olsen, previously founder and CEO of forex platform OANDA. Lykke is a new but growing platform that allows users to trade fiat currencies, cryptocurrencies and cryptographic tokens using either an iOS or Android device.

ChronoBank CEO, Sergei Sergienko said:

There is a strong emphasis on user experience and a low barrier to entry. One of the reasons we’re thrilled to be partnering with Lykke is that commitment to making cryptocurrency accessible to new users, since we are looking at mass-market applications for crypto tokens, it promises to be a very worthwhile partnership.

The Lykke exchange charges no fees and uses so called ‘colored coins’ — crypto tokens which can represent real-world assets from bonds to gold, but which settle on the bitcoin blockchain in minutes. Lykke, which is a member of the Hyperledger project, has already gone public on its own exchange and is currently building enterprise-scale solutions for large financial institutions.